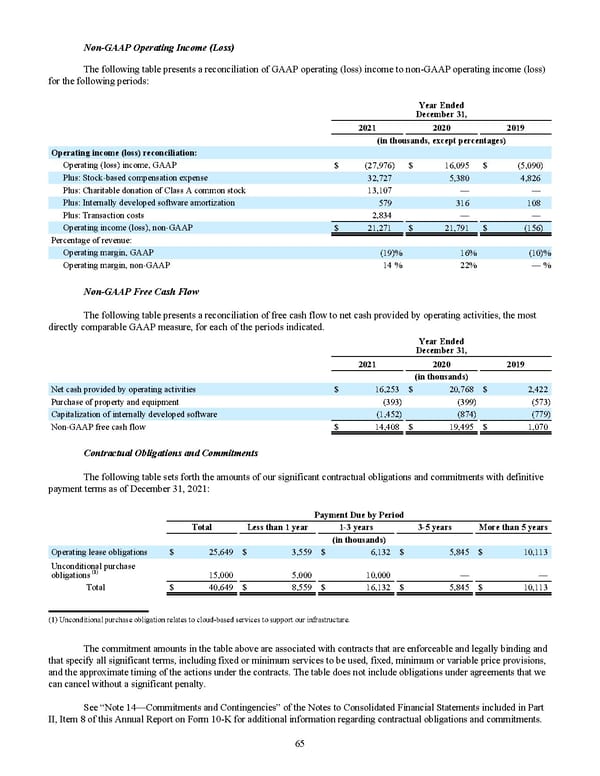

Non-GAAP Operating Income (Loss) The following table presents a reconciliation of GAAP operating (loss) income to non-GAAP operating income (loss) for the following periods : Year Ended December 31, 2021 2020 2019 (in thousands, except percentages) Operating income (loss) reconciliation: Operating (loss) income, GAAP $ (27,976) $ 16,095 $ (5,090) Plus: Stock-based compensation expense 32,727 5,380 4,826 Plus: Charitable donation of Class A common stock 13,107 — — Plus: Internally developed software amortization 579 316 108 Plus: Transaction costs 2,834 — — Operating income (loss), non-GAAP $ 21,271 $ 21,791 $ (156) Percentage of revenue: Operating margin, GAAP (19) % 16 % (10) % Operating margin, non-GAAP 14 % 22 % — % Non-GAAP Free Cash Flow The following table presents a reconciliation of free cash flow to net cash provided by operating activities, the most directly comparable GAAP measure, for each of the periods indicat e d . Year Ended December 31, 2021 2020 2019 (in thousands) Net cash provided by operating activities $ 16,253 $ 20,768 $ 2,422 Purchase of property and equipment (393) (399) (573) Capitalization of internally developed software (1,452) (874) (779) Non-GAAP free cash flow $ 14,408 $ 19,495 $ 1,070 Contractual Obligations and Commitments The following table sets forth the amounts of our significant contractual obligations and commitments with definitive payment terms as of December 31, 2021 : Payment Due by Period Total Less than 1 year 1-3 years 3-5 years More than 5 years (in thousands) Operating lease obligations $ 25,649 $ 3,559 $ 6,132 $ 5,845 $ 10,113 Unconditional purchase obligations (1) 15,000 5,000 10,000 — — Total $ 40,649 $ 8,559 $ 16,132 $ 5,845 $ 10,113 (1) Unconditional purchase obligation relates to cloud-based services to support our infrastructure. The commitment amounts in the table above are associated with contracts that are enforceable and legally binding and that specify all significant terms, including fixed or minimum services to be used, fixed, minimum or variable price provisions, and the approximate timing of the actions under the contracts. The table does not include obligations under agreements that we can cancel without a significant penalty. See “Note 14 — Commitments and Contingencies” of the Notes to Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K for additional information regarding contractual obligations and commitments. 65

2022 10K Page 71 Page 73

2022 10K Page 71 Page 73