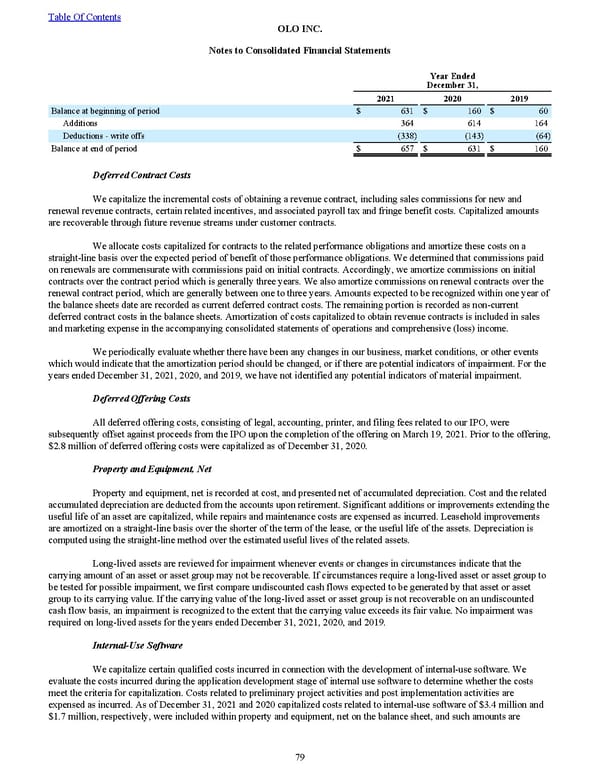

Year Ended December 31, 2021 2020 2019 Balance at beginning of period $ 631 $ 160 $ 60 Additions 364 614 164 Deductions - write offs (338) (143) (64) Balance at end of period $ 657 $ 631 $ 160 Deferred Contract Costs We capitalize the incremental costs of obtaining a revenue contract, including sales commissions for new and renewal revenue contracts, certain related incentives, and associated payroll tax and fringe benefit costs. Capitalized amounts are recoverable through future revenue streams under customer contracts. We allocate costs capitalized for contracts to the related performance obligations and amortize these costs on a straight-line basis over the expected period of benefit of those performance obligations. We determined that commissions paid on renewals are commensurate with commissions paid on initial contracts. Accordingly, we amortize commissions on initial contracts over the contract period which is generally three years. We also amortize commissions on renewal contracts over the renewal contract period, which are generally between one to three years. Amounts expected to be recognized within one year of the balance sheets date are recorded as current deferred contract costs. The remaining portion is recorded as non-current deferred contract costs in the balance sheets. Amortization of costs capitalized to obtain revenue contracts is included in sales and marketing expense in the accompanying consolidated statements of operations and comprehensive (loss) income. We periodically evaluate whether there have been any changes in our business, market conditions, or other events which would indicate that the amortization period should be changed, or if there are potential indicators of impairment. For the years ended December 31, 2021 , 2020 , and 2019 , we have not identified any potential indicators of material impairment. Deferred Offering Costs All deferred offering costs, consisting of legal, accounting, printer, and filing fees related to our IPO, were subsequently offset against proceeds from the IPO upon the completion of the offering on March 19, 2021 . Prior to the offering, $2.8 million of deferred offering costs were capitalized as of December 31, 2020 . Property and Equipment, Net Property and equipment, net is recorded at cost, and presented net of accumulated depreciation. Cost and the related accumulated depreciation are deducted from the accounts upon retirement. Significant additions or improvements extending the useful life of an asset are capitalized, while repairs and maintenance costs are expensed as incurred. Leasehold improvements are amortized on a straight-line basis over the shorter of the term of the lease, or the useful life of the assets. Depreciation is computed using the straight-line method over the estimated useful lives of the related assets. Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be recoverable. If circumstances require a long-lived asset or asset group to be tested for possible impairment, we first compare undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. No impairment was required on long-lived assets for the years ended December 31, 2021 , 2020 , and 2019 . Internal-Use Software We capitalize certain qualified costs incurred in connection with the development of internal-use software. We evaluate the costs incurred during the application development stage of internal use software to determine whether the costs meet the criteria for capitalization. Costs related to preliminary project activities and post implementation activities are expensed as incurred. As of December 31, 2021 and 2020 capitalized costs related to internal-use software of $3.4 million and $1.7 million , respectively, we re included within property and equipment, net on the balance sheet, and such amounts are Table Of Contents OLO INC. Notes to Consolidated Financial Statements 79

2022 10K Page 85 Page 87

2022 10K Page 85 Page 87