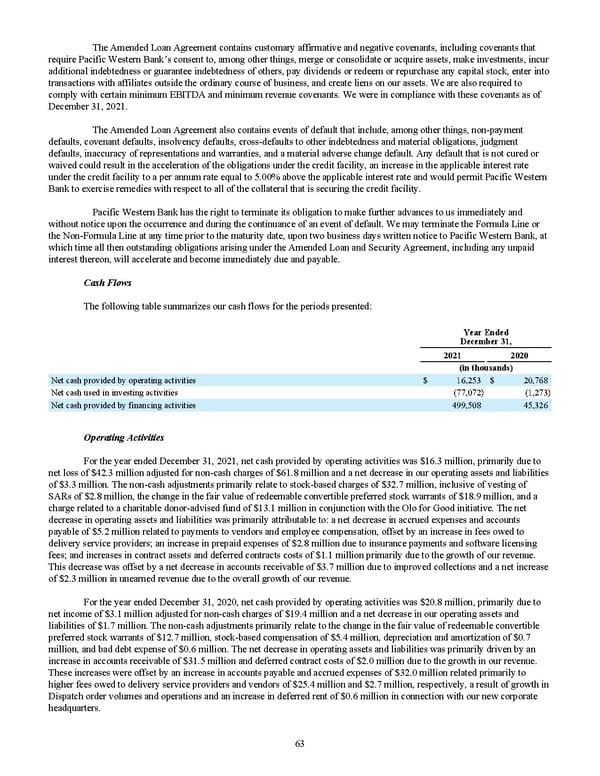

The Amended Loan Agreement contains customary affirmative and negative covenants, including covenants that require Pacific Western Bank’s consent to, among other things, merge or consolidate or acquire assets, make investments, incur additional indebtedness or guarantee indebtedness of others, pay dividends or redeem or repurchase any capital stock, enter into transactions with affiliates outside the ordinary course of business, and create liens on our assets. We are also required to comply with certain minimum EBITDA and minimum revenue covenants. We were in compliance with these covenants as of December 31, 2021 . The Amended Loan Agreement also contains events of default that include, among other things, non-payment defaults, covenant defaults, insolvency defaults, cross-defaults to other indebtedness and material obligations, judgment defaults, inaccuracy of representations and warranties, and a material adverse change default. Any default that is not cured or waived could result in the acceleration of the obligations under the credit facility, an increase in the applicable interest rate under the credit facility to a per annum rate equal to 5.00% above the applicable interest rate and would permit Pacific Western Bank to exercise remedies with respect to all of the collateral that is securing the credit facility. Pacific Western Bank has the right to terminate its obligation to make further advances to us immediately and without notice upon the occurrence and during the continuance of an event of default. We may terminate the Formula Line or the Non-Formula Line at any time prior to the maturity date, upon two business days written notice to Pacific Western Bank, at which time all then outstanding obligations arising under the Amended Loan and Security Agreement, including any unpaid interest thereon, will accelerate and become immediately due and payable. Cash Flows The following table summarizes our cash flows for the periods presented : Year Ended December 31, 2021 2020 (in thousands) Net cash provided by operating activities $ 16,253 $ 20,768 Net cash used in investing activities (77,072) (1,273) Net cash provided by financing activities 499,508 45,326 Operating Activities For the year ended December 31, 2021 , net cash provided by operating activities was $16.3 million , primarily due to net loss of $42.3 million adjusted for non-cash charges of $61.8 million and a net decrease in our operating assets and liabilities of $3.3 million . The non-cash adjustments primarily relate to stock-based charges of $32.7 million , inclusive of vesting of SARs of $2.8 million , the change in the fair value of redeemable convertible preferred stock warrants of $18.9 million , and a charge related to a charitable donor-advised fund of $13.1 million in conjunction with the Olo for Good initiative . The net decrease in operating assets and liabilities was primarily attributable to: a net decrease in accrued expenses and accounts payable of $5.2 million related to payments to vendors and employee compensation, offset by an increase in fees owed to delivery service providers; an increase in prepaid expenses of $2.8 million due to insurance payments and software licensing fees; and increases in contract assets and deferred contracts costs of $1.1 million primarily due to the growth of our revenue. This decrease was offset by a net decrease in accounts receivable of $3.7 million due to improved collections and a net increase of $2.3 million in unearned revenue due to the overall growth of our revenue. For the year ended December 31, 2020 , net cash provided by operating activities was $20.8 million , primarily due to net income of $3.1 million adjusted for non-cash charges of $19.4 million and a net decrease in our operating assets and liabilities of $1.7 million . The non-cash adjustments primarily relate to the change in the fair value of redeemable convertible preferred stock warrants of $12.7 million , stock-based compensation of $5.4 million , depreciation and amortization of $0.7 million , and bad debt expense of $0.6 million . The net decrease in operating assets and liabilities was primarily driven by an increase in accounts receivable of $31.5 million and deferred contract costs of $2.0 million due to the growth in our revenue. These increases were offset by an increase in accounts payable and accrued expenses of $32.0 million related primarily to higher fees owed to delivery service providers and vendors of $25.4 million and $2.7 million, respectively, a result of growth in Dispatch order volumes and operations and an increase in deferred rent of $0.6 million in connection with our new corporate headquarters. 63

2022 10K Page 69 Page 71

2022 10K Page 69 Page 71