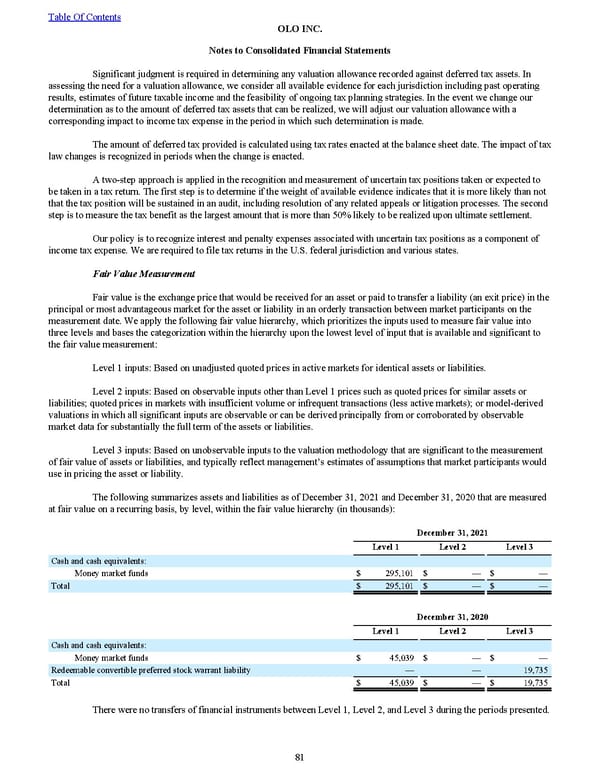

Significant judgment is required in determining any valuation allowance recorded against deferred tax assets. In assessing the need for a valuation allowance, we consider all available evidence for each jurisdiction including past operating results, estimates of future taxable income and the feasibility of ongoing tax planning strategies. In the event we change our determination as to the amount of deferred tax assets that can be realized, we will adjust our valuation allowance with a corresponding impact to income tax expense in the period in which such determination is made. The amount of deferred tax provided is calculated using tax rates enacted at the balance sheet date. The impact of tax law changes is recognized in periods when the change is enacted. A two-step approach is applied in the recognition and measurement of uncertain tax positions taken or expected to be taken in a tax return. The first step is to determine if the weight of available evidence indicates that it is more likely than not that the tax position will be sustained in an audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. Our policy is to recognize interest and penalty expenses associated with uncertain tax positions as a component of income tax expense. We are required to file tax returns in the U.S. federal jurisdiction and various states. Fair Value Measurement Fair value is the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. We apply the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement: Level 1 inputs: Based on unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 inputs: Based on observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 inputs: Based on unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities, and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The following summarizes assets and liabilities as of December 31, 2021 and December 31, 2020 that are measured at fair value on a recurring basis, by level, within the fair value hierarchy (in thousands): December 31, 2021 Level 1 Level 2 Level 3 Cash and cash equivalents: Money market funds $ 295,101 $ — $ — Total $ 295,101 $ — $ — December 31, 2020 Level 1 Level 2 Level 3 Cash and cash equivalents: Money market funds $ 45,039 $ — $ — Redeemable convertible preferred stock warrant liability — — 19,735 Total $ 45,039 $ — $ 19,735 There were no transfers of financial instruments between Level 1, Level 2, and Level 3 during the periods presented. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 81

2022 10K Page 87 Page 89

2022 10K Page 87 Page 89