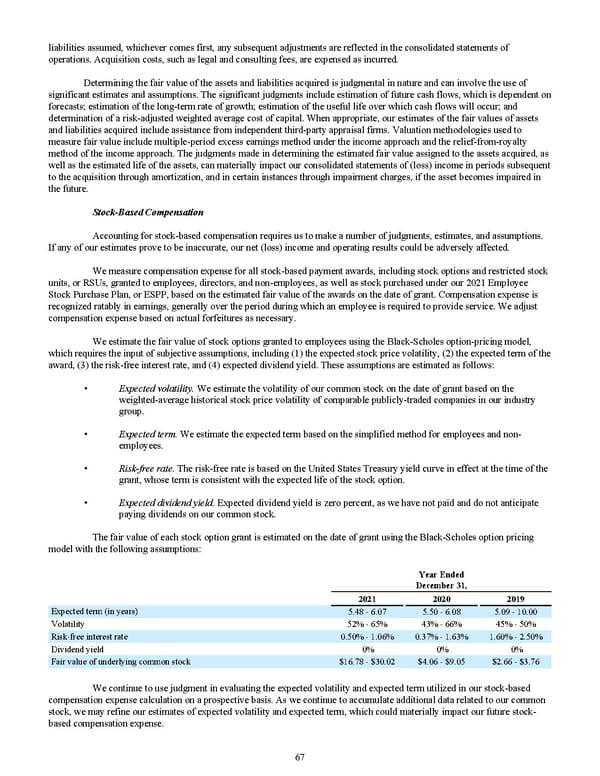

liabilities assumed, whichever comes first, any subsequent adjustments are reflected in the consolidated statements of operations. Acquisition costs, such as legal and consulting fees, are expensed as incurred. Determining the fair value of the assets and liabilities acquired is judgmental in nature and can involve the use of significant estimates and assumptions. The significant judgments include estimation of future cash flows, which is dependent on forecasts; estimation of the long-term rate of growth; estimation of the useful life over which cash flows will occur; and determination of a risk-adjusted weighted average cost of capital. When appropriate, our estimates of the fair values of assets and liabilities acquired include assistance from independent third-party appraisal firms. Valuation methodologies used to measure fair value include multiple-period excess earnings method under the income approach and the relief-from-royalty method of the income approach. The judgments made in determining the estimated fair value assigned to the assets acquired, as well as the estimated life of the assets, can materially impact our consolidated statements of (loss) income in periods subsequent to the acquisition through amortization, and in certain instances through impairment charges, if the asset becomes impaired in the future. Stock-Based Compensation Accounting for stock-based compensation requires us to make a number of judgments, estimates, and assumptions. If any of our estimates prove to be inaccurate, our net (loss) income and operating results could be adversely affected. We measure compensation expense for all stock-based payment awards, including stock options and restricted stock units, or RSUs, granted to employees, directors, and non-employees, as well as stock purchased under our 2021 Employee Stock Purchase Plan, or ESPP , based on the estimated fair value of the awards on the date of grant. Compensation expense is recognized ratably in earnings, generally over the period during which an employee is required to provide service. We adjust compensation expense based on actual forfeitures as necessary. We estimate the fair value of stock options granted to employees using the Black-Scholes option-pricing model, which requires the input of subjective assumptions, including (1) the expected stock price volatility, (2) the expected term of the award, (3) the risk-free interest rate, and (4) expected dividend yield. These assumptions are estimated as follows: • Expected volatility. We estimate the volatility of our common stock on the date of grant based on the weighted-average historical stock price volatility of comparable publicly-traded companies in our industry group. • Expected term. We estimate the expected term based on the simplified method for employees and non- employees. • Risk-free rate. The risk-free rate is based on the United States Treasury yield curve in effect at the time of the grant, whose term is consistent with the expected life of the stock option. • Expected dividend yield. Expected dividend yield is zero percent, as we have not paid and do not anticipate paying dividends on our common stock. The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions: Year Ended December 31, 2021 2020 2019 Expected term (in years) 5.48 - 6.07 5.50 - 6.08 5.09 - 10.00 Volatility 52% - 65% 43% - 66% 45% - 50% Risk-free interest rate 0.50% - 1.06% 0.37% - 1.63% 1.60% - 2.50% Dividend yield 0% 0% 0% Fair value of underlying common stock $16.78 - $30.02 $4.06 - $9.05 $2.66 - $3.76 We continue to use judgment in evaluating the expected volatility and expected term utilized in our stock-based compensation expense calculation on a prospective basis. As we continue to accumulate additional data related to our common stock, we may refine our estimates of expected volatility and expected term, which could materially impact our future stock- based compensation expense. 67

2022 10K Page 73 Page 75

2022 10K Page 73 Page 75