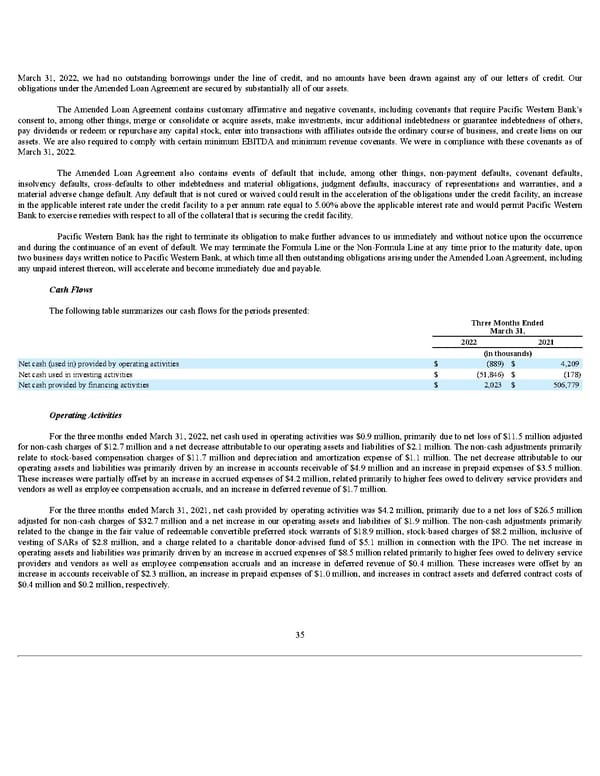

March 31, 2022, we had no outstanding borrowings under the line of credit , and no amounts have been drawn against any of our letters of credit. Our obligations under the Amended Loan Agreement are secured by substantially all of our assets. The Amended Loan Agreement contains customary affirmative and negative covenants, including covenants that require Pacific Western Bank’s consent to, among other things, merge or consolidate or acquire assets, make investments, incur additional indebtedness or guarantee indebtedness of others, pay dividends or redeem or repurchase any capital stock, enter into transactions with affiliates outside the ordinary course of business, and create liens on our assets. We are also required to comply with certain minimum EBITDA and minimum revenue covenants. We were in compliance with these covenants as of March 31, 2022. The Amended Loan Agreement also contains events of default that include, among other things, non-payment defaults, covenant defaults, insolvency defaults, cross-defaults to other indebtedness and material obligations, judgment defaults, inaccuracy of representations and warranties, and a material adverse change default. Any default that is not cured or waived could result in the acceleration of the obligations under the credit facility, an increase in the applicable interest rate under the credit facility to a per annum rate equal to 5.00% above the applicable interest rate and would permit Pacific Western Bank to exercise remedies with respect to all of the collateral that is securing the credit facility. Pacific Western Bank has the right to terminate its obligation to make further advances to us immediately and without notice upon the occurrence and during the continuance of an event of default. We may terminate the Formula Line or the Non-Formula Line at any time prior to the maturity date, upon two business days written notice to Pacific Western Bank, at which time all then outstanding obligations arising under the Amended Loan Agreement, including any unpaid interest thereon, will accelerate and become immediately due and payable. Cash Flows The following table summarizes our cash flows for the periods presented: Three Months Ended March 31, 2022 2021 (in thousands) Net cash (used in) provided by operating activities $ (889) $ 4,209 Net cash used in investing activities $ (51,846) $ (178) Net cash provided by financing activities $ 2,023 $ 506,779 Operating Activities For the three months ended March 31, 2022, net cash used in operating activities was $0.9 million, primarily due to net loss of $11.5 million adjusted for non-cash charges of $12.7 million and a net decrease attributable to our operating assets and liabilities of $2.1 million. The non-cash adjustments primarily relate to stock-based compensation charges of $11.7 million and depreciation and amortization expense of $1.1 million. The net decrease attributable to our operating assets and liabilities was primarily driven by an increase in accounts receivable of $4.9 million and an increase in prepaid expenses of $3.5 million. These increases were partially offset by an increase in accrued expenses of $4.2 million, related primarily to higher fees owed to delivery service providers and vendors as well as employee compensation accruals, and an increase in deferred revenue of $1.7 million. For the three months ended March 31, 2021, net cash provided by operating activities was $4.2 million, primarily due to a net loss of $26.5 million adjusted for non-cash charges of $32.7 million and a net increase in our operating assets and liabilities of $1.9 million. The non-cash adjustments primarily related to the change in the fair value of redeemable convertible preferred stock warrants of $18.9 million, stock-based charges of $8.2 million, inclusive of vesting of SARs of $2.8 million, and a charge related to a charitable donor-advised fund of $5.1 million in connection with the IPO. The net increase in operating assets and liabilities was primarily driven by an increase in accrued expenses of $8.5 million related primarily to higher fees owed to delivery service providers and vendors as well as employee compensation accruals and an increase in deferred revenue of $0.4 million. These increases were offset by an increase in accounts receivable of $2.3 million, an increase in prepaid expenses of $1.0 million, and increases in contract assets and deferred contract costs of $0.4 million and $0.2 million, respectively. 35

Q1 2022 10Q Page 38 Page 40

Q1 2022 10Q Page 38 Page 40