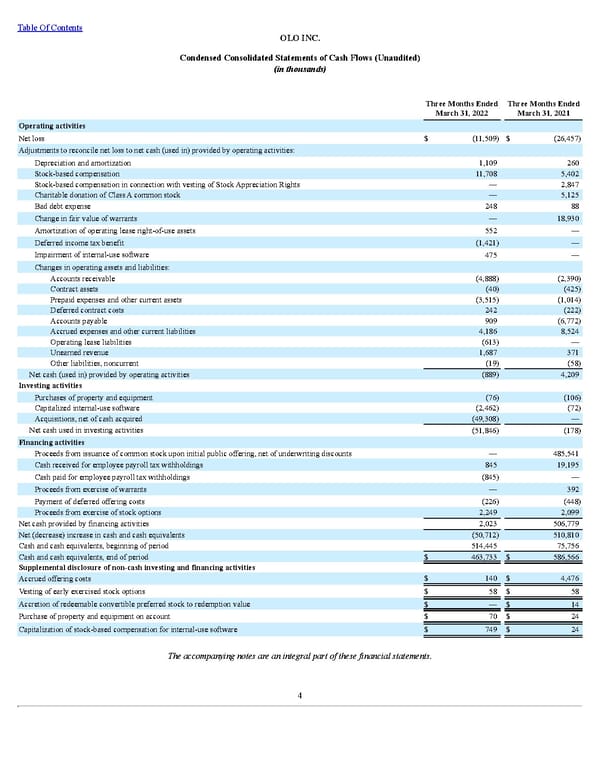

Table Of Contents OLO INC. Condensed Consolidated Statements of Cash Flows (Unaudited) (in thousands) Three Months Ended March 31, 2022 Three Months Ended March 31, 2021 Operating activities Net loss $ (11,509) $ (26,457) Adjustments to reconcile net loss to net cash (used in) provided by operating activities: Depreciation and amortization 1,109 260 Stock-based compensation 11,708 5,402 Stock-based compensation in connection with vesting of Stock Appreciation Rights — 2,847 Charitable donation of Class A common stock — 5,125 Bad debt expense 248 88 Change in fair value of warrants — 18,930 Amortization of operating lease right-of-use assets 552 — Deferred income tax benefit (1,421) — Impairment of internal-use software 475 — Changes in operating assets and liabilities: Accounts receivable (4,888) (2,390) Contract assets (40) (425) Prepaid expenses and other current assets (3,515) (1,014) Deferred contract costs 242 (222) Accounts payable 909 (6,772) Accrued expenses and other current liabilities 4,186 8,524 Operating lease liabilities (613) — Unearned revenue 1,687 371 Other liabilities, noncurrent (19) (58) Net cash (used in) provided by operating activities (889) 4,209 Investing activities Purchases of property and equipment (76) (106) Capitalized internal-use software (2,462) (72) Acquisitions, net of cash acquired (49,308) — Net cash used in investing activities (51,846) (178) Financing activities Proceeds from issuance of common stock upon initial public of fering, net of underwriting discounts — 485,541 Cash received for employee payroll tax withholdings 845 19,195 Cash paid for employee payroll tax withholdings (845) — Proceeds from exercise of warrants — 392 Payment of deferred of fering costs (226) (448) Proceeds from exercise of stock options 2,249 2,099 Net cash provided by financing activities 2,023 506,779 Net (decrease) increase in cash and cash equivalents (50,712) 510,810 Cash and cash equivalents, beginning of period 514,445 75,756 Cash and cash equivalents, end of period $ 463,733 $ 586,566 Supplemental disclosur e of non-cash investing and financing activities Accrued of fering costs $ 140 $ 4,476 Vesting of early exercised stock options $ 58 $ 58 Accretion of redeemable convertible preferred stock to redemption value $ — $ 14 Purchase of property and equipment on account $ 70 $ 24 Capitalization of stock-based compensation for internal-use software $ 749 $ 24 The accompanying notes are an integral part of these financial statements. 4

Q1 2022 10Q Page 7 Page 9

Q1 2022 10Q Page 7 Page 9