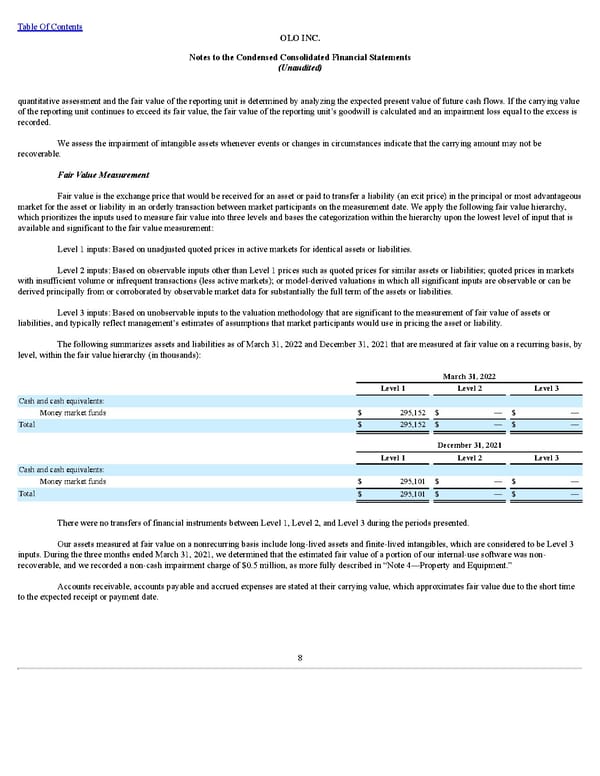

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) quantitative assessment and the fair value of the reporting unit is determined by analyzing the expected present value of future cash flows. If the carrying value of the reporting unit continues to exceed its fair value, the fair value of the reporting unit’s goodwill is calculated and an impairment loss equal to the excess is recorded. We assess the impairment of intangible assets whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Fair Value Measurement Fair value is the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. We apply the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement: Level 1 inputs: Based on unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 inputs: Based on observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 inputs: Based on unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities, and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The following summarizes assets and liabilities as of March 31, 2022 and December 31, 2021 that are measured at fair value on a recurring basis, by level, within the fair value hierarchy (in thousands): March 31, 2022 Level 1 Level 2 Level 3 Cash and cash equivalents: Money market funds $ 295,152 $ — $ — Total $ 295,152 $ — $ — December 31, 2021 Level 1 Level 2 Level 3 Cash and cash equivalents: Money market funds $ 295,101 $ — $ — Total $ 295,101 $ — $ — There were no transfers of financial instruments between Level 1, Level 2, and Level 3 during the periods presented. Our assets measured at fair value on a nonrecurring basis include long-lived assets and finite-lived intangibles, which are considered to be Level 3 inputs. During the three months ended March 31, 2021, we determined that the estimated fair value of a portion of our internal-use software was non- recoverable, and we recorded a non-cash impairment charge of $0.5 million, as more fully described in “Note 4—Property and Equipment.” Accounts receivable, accounts payable and accrued expenses are stated at their carrying value, which approximates fair value due to the short time to the expected receipt or payment date. 8

Q1 2022 10Q Page 11 Page 13

Q1 2022 10Q Page 11 Page 13