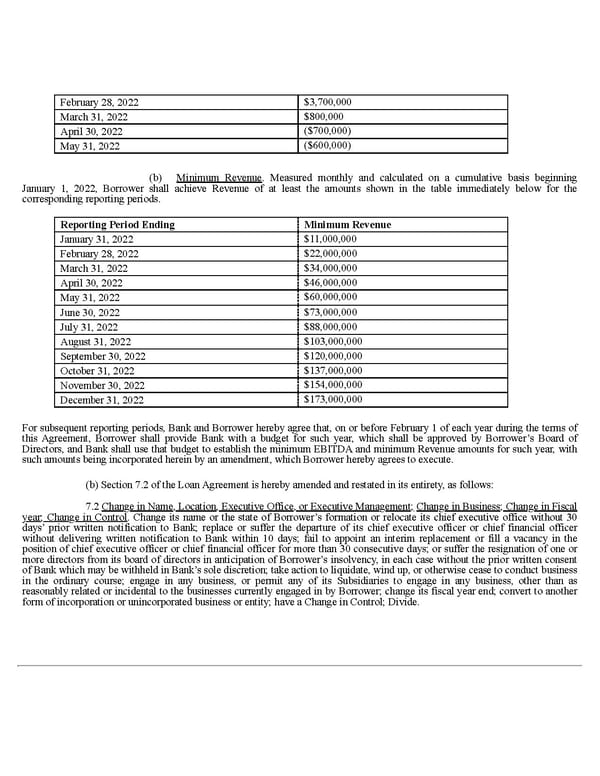

February 28, 2022 $3,700,000 March 31, 2022 $800,000 April 30, 2022 ($700,000) May 31, 2022 ($600,000) (b) Minimum Revenue . Measured monthly and calculated on a cumulative basis beginning January 1, 2022, Borrower shall achieve Revenue of at least the amounts shown in the table immediately below for the corresponding reporting periods. Reporting Period Ending Minimum Revenue January 31, 2022 $11,000,000 February 28, 2022 $22,000,000 March 31, 2022 $34,000,000 April 30, 2022 $46,000,000 May 31, 2022 $60,000,000 June 30, 2022 $73,000,000 July 31, 2022 $88,000,000 August 31, 2022 $103,000,000 September 30, 2022 $120,000,000 October 31, 2022 $137,000,000 November 30, 2022 $154,000,000 December 31, 2022 $173,000,000 For subsequent reporting periods, Bank and Borrower hereby agree that, on or before February 1 of each year during the terms of this Agreement, Borrower shall provide Bank with a budget for such year, which shall be approved by Borrower ’s Board of Directors, and Bank shall use that budget to establish the minimum EBITDA and minimum Revenue amounts for such year, with such amounts being incorporated herein by an amendment, which Borrower hereby agrees to execute. (b) Section 7.2 of the Loan Agreement is hereby amended and restated in its entirety , as follows: 7.2 Change in Name, Location, Executive Office, or Executive Management; Change in Business; Change in Fiscal year; Change in Control . Change its name or the state of Borrower ’s formation or relocate its chief executive office without 30 days’ prior written notification to Bank; replace or suffer the departure of its chief executive officer or chief financial officer without delivering written notification to Bank within 10 days; fail to appoint an interim replacement or fill a vacancy in the position of chief executive officer or chief financial officer for more than 30 consecutive days; or suffer the resignation of one or more directors from its board of directors in anticipation of Borrower ’s insolve ncy, in each case without the prior written consent of Bank which may be withheld in Bank’s sole discretion; take action to liquidate, wind up, or otherwise cease to conduct business in the ordinary course; engage in any business, or permit any of its Subsidiaries to engage in any business, other than as reasonably related or incidental to the businesses currently engaged in by Borrower; change its fiscal year end; convert to another form of incorporation or unincorporated business or entity; have a Change in Control; Divide.

Q1 2022 10Q Page 66 Page 68

Q1 2022 10Q Page 66 Page 68