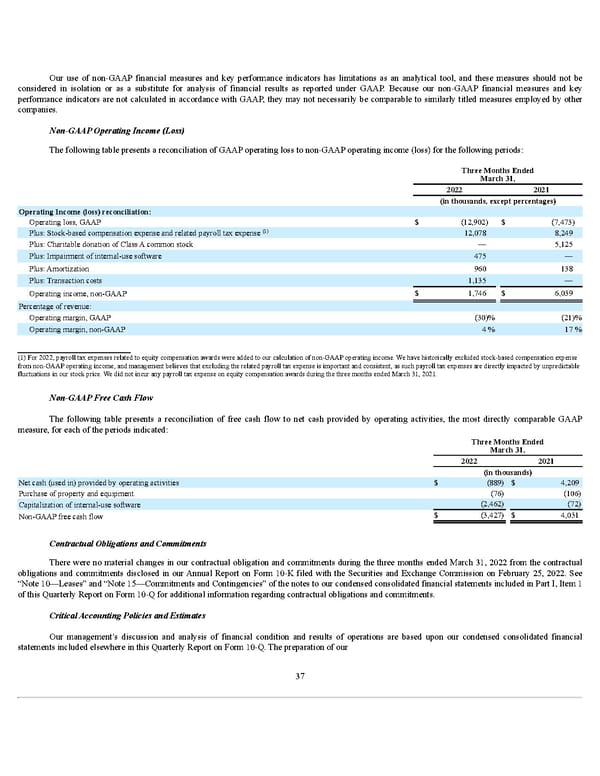

Our use of non-GAAP financial measures and key performance indicators has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP. Because our non-GAAP financial measures and key performance indicators are not calculated in accordance with GAAP, they may not necessarily be comparable to similarly titled measures employed by other companies. Non-GAAP Operating Income (Loss) The following table presents a reconciliation of GAAP operating loss to non-GAAP operating income (loss) for the following periods: Three Months Ended March 31, 2022 2021 (in thousands, except per centages) Operating Income (loss) r econciliation: Operating loss, GAAP $ (12,902) $ (7,473) Plus: Stock-based compensation expense and related payroll tax expense 12,078 8,249 Plus: Charitable donation of Class A common stock — 5,125 Plus: Impairment of internal-use software 475 — Plus: Amortization 960 138 Plus: Transaction costs 1,135 — Operating income, non-GAAP $ 1,746 $ 6,039 Percentage of revenue: Operating mar gin, GAAP (30) % (21) % Operating mar gin, non-GAAP 4 % 17 % Non-GAAP Free Cash Flow The following table presents a reconciliation of free cash flow to net cash provided by operating activities, the most directly comparable GAAP measure, for each of the periods indicated: Three Months Ended March 31, 2022 2021 (in thousands) Net cash (used in) provided by operating activities $ (889) $ 4,209 Purchase of property and equipment (76) (106) Capitalization of internal-use software (2,462) (72) Non-GAAP free cash flow $ (3,427) $ 4,031 Contractual Obligations and Commitments There were no material changes in our contractual obligation and commitments during the three months ended March 31, 2022 from the contractual obligations and commitments disclosed in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 25, 2022. See “Note 10—Leases” and “Note 15—Commitments and Contingencies” of the notes to our condensed consolidated financial statements included in Part I, Item 1 of this Quarterly Report on Form 10-Q for additional information regarding contractual obligations and commitments. Critical Accounting Policies and Estimates Our management’s discussion and analysis of financial condition and results of operations are based upon our condensed consolidated financial statements included elsewhere in this Quarterly Report on Form 10-Q. The preparation of our (1) (1) For 2022, payroll tax expenses related to equity compensation awards were added to our calculation of non-GAAP operating income. We have historically excluded stock-based compensation expense from non-GAAP operating income, and management believes that excluding the related payroll tax expense is important and consistent, as such payroll tax expenses are directly impacted by unpredictable fluctuations in our stock price. We did not incur any payroll tax expense on equity compensation awards during the three months ended March 31, 2021. 37

Q1 2022 10Q Page 40 Page 42

Q1 2022 10Q Page 40 Page 42