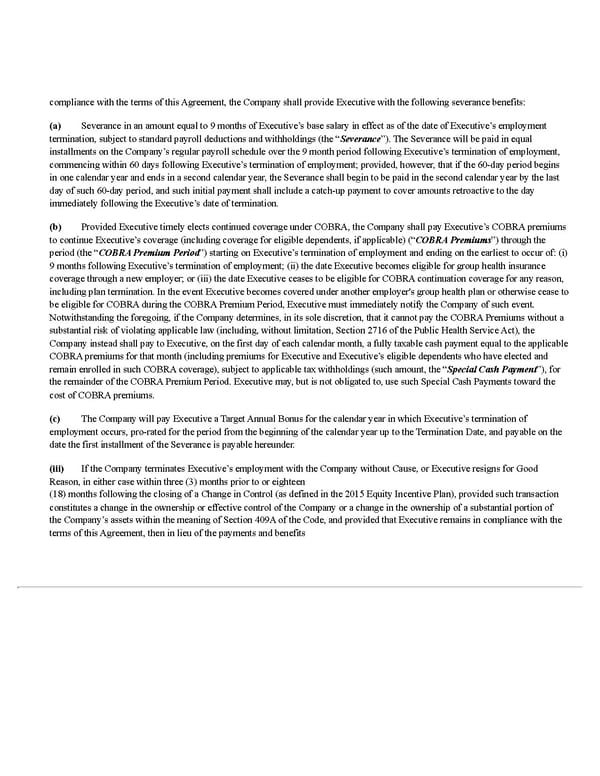

compliance with the terms of this Agreement, the Company shall provide Executive with the following severance benefits: (a) Severance in an amount equal to 9 months of Executive’s base salary in effect as of the date of Executive’s employment termination, subject to standard payroll deductions and withholdings (the “ Severance ”). The Severance will be paid in equal installments on the Company’s regular payroll schedule over the 9 month period following Executive’s termination of employment, commencing within 60 days following Executive’s termination of employment; provided, however, that if the 60-day period begins in one calendar year and ends in a second calendar year, the Severance shall begin to be paid in the second calendar year by the last day of such 60-day period, and such initial payment shall include a catch-up payment to cover amounts retroactive to the day immediately following the Executive’s date of termination. (b) Provided Executive timely elects continued coverage under COBRA, the Company shall pay Executive’s COBRA premiums to continue Executive’s coverage (including coverage for eligible dependents, if applicable) (“ COBRA Premiums ”) through the period (the “ COBRA Premium Period ”) starting on Executive’s termination of employment and ending on the earliest to occur of: (i) 9 months following Executive’s termination of employment; (ii) the date Executive becomes eligible for group health insurance coverage through a new employer; or (iii) the date Executive ceases to be eligible for COBRA continuation coverage for any reason, including plan termination. In the event Executive becomes covered under another employer's group health plan or otherwise cease to be eligible for COBRA during the COBRA Premium Period, Executive must immediately notify the Company of such event. Notwithstanding the foregoing, if the Company determines, in its sole discretion, that it cannot pay the COBRA Premiums without a substantial risk of violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), the Company instead shall pay to Executive, on the first day of each calendar month, a fully taxable cash payment equal to the applicable COBRA premiums for that month (including premiums for Executive and Executive’s eligible dependents who have elected and remain enrolled in such COBRA coverage), subject to applicable tax withholdings (such amount, the “ Special Cash Payment ”), for the remainder of the COBRA Premium Period. Executive may, but is not obligated to, use such Special Cash Payments toward the cost of COBRA premiums. (c) The Company will pay Executive a Target Annual Bonus for the calendar year in which Executive’s termination of employment occurs, pro-rated for the period from the beginning of the calendar year up to the Termination Date, and payable on the date the first installment of the Severance is payable hereunder. (iii) If the Company terminates Executive’s employment with the Company without Cause, or Executive resigns for Good Reason, in either case within three (3) months prior to or eighteen (18) months following the closing of a Change in Control (as defined in the 2015 Equity Incentive Plan), provided such transaction constitutes a change in the ownership or effective control of the Company or a change in the ownership of a substantial portion of the Company’s assets within the meaning of Section 409A of the Code, and provided that Executive remains in compliance with the terms of this Agreement, then in lieu of the payments and benefits

Q1 2022 10Q Page 52 Page 54

Q1 2022 10Q Page 52 Page 54