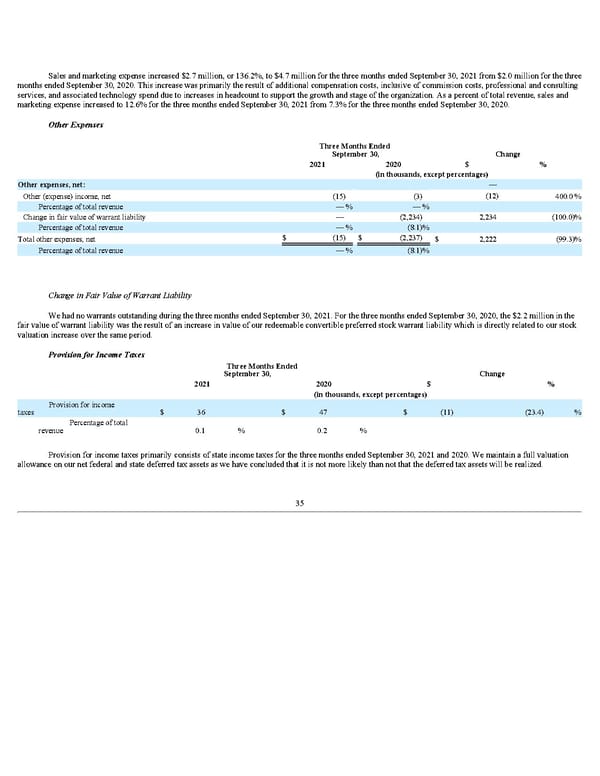

Sales and marketing expense increased $2.7 million, or 136.2%, to $4.7 million for the three months ended September 30, 2021 from $2.0 million for the three months ended September 30, 2020. This increase was primarily the result of additional compensation costs, inclusive of commission costs, professional and consulting services, and associated technology spend due to increases in headcount to support the growth and stage of the organization. As a percent of total revenue, sales and marketing expense increased to 12.6% for the three months ended September 30, 2021 from 7.3% for the three months ended September 30, 2020. Other Expenses Three Months Ended September 30, Change 2021 2020 $ % (in thousands, except percentages) Other expenses, net: — Other (expense) income, net (15) (3) (12) 400.0 % Percentage of total revenue — % — % Change in fair value of warrant liability — (2,234) 2,234 (100.0) % Percentage of total revenue — % (8.1) % Total other expenses, net $ (15) $ (2,237) $ 2,222 (99.3) % Percentage of total revenue — % (8.1) % Change in Fair Value of Warrant Liability We had no warrants outstanding during the three months ended September 30, 2021. For the three months ended September 30, 2020, the $2.2 million in the fair value of warrant liability was the result of an increase in value of our redeemable convertible preferred stock warrant liability which is directly related to our stock valuation increase over the same period. Provision for Income Taxes Three Months Ended September 30, Change 2021 2020 $ % (in thousands, except percentages) Provision for income taxes $ 36 $ 47 $ (11) (23.4) % Percentage of total revenue 0.1 % 0.2 % Provision for income taxes primarily consists of state income taxes for the three months ended September 30, 2021 and 2020. We maintain a full valuation allowance on our net federal and state deferred tax assets as we have concluded that it is not more likely than not that the deferred tax assets will be realized. 35

Q3 2021 10Q Page 40 Page 42

Q3 2021 10Q Page 40 Page 42