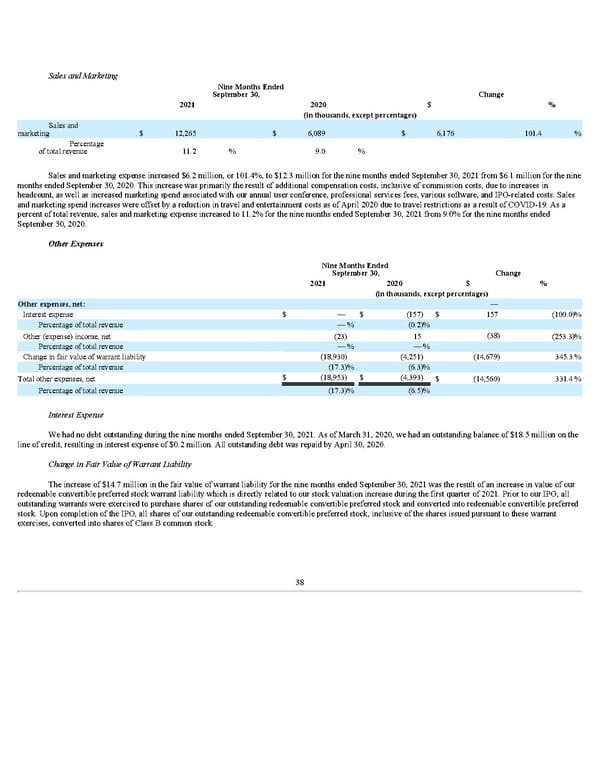

Sales and Marketing Nine Months Ended September 30, Change 2021 2020 $ % (in thousands, except percentages) Sales and marketing $ 12,265 $ 6,089 $ 6,176 101.4 % Percentage of total revenue 11.2 % 9.0 % Sales and marketing expense increased $6.2 million, or 101.4%, to $12.3 million for the nine months ended September 30, 2021 from $6.1 million for the nine months ended September 30, 2020. This increase was primarily the result of additional compensation costs, inclusive of commission costs, due to increases in headcount, as well as increased marketing spend associated with our annual user conference, professional services fees, various software, and IPO-related costs. Sales and marketing spend increases were offset by a reduction in travel and entertainment costs as of April 2020 due to travel restrictions as a result of COVID-19. As a percent of total revenue, sales and marketing expense increased to 11.2% for the nine months ended September 30, 2021 from 9.0% for the nine months ended September 30, 2020. Other Expenses Nine Months Ended September 30, Change 2021 2020 $ % (in thousands, except percentages) Other expenses, net: — Interest expense $ — $ (157) $ 157 (100.0) % Percentage of total revenue — % (0.2) % Other (expense) income, net (23) 15 (38) (253.3) % Percentage of total revenue — % — % Change in fair value of warrant liability (18,930) (4,251) (14,679) 345.3 % Percentage of total revenue (17.3) % (6.3) % Total other expenses, net $ (18,953) $ (4,393) $ (14,560) 331.4 % Percentage of total revenue (17.3) % (6.5) % Interest Expense We had no debt outstanding during the nine months ended September 30, 2021. As of March 31, 2020, we had an outstanding balance of $18.5 million on the line of credit, resulting in interest expense of $0.2 million. All outstanding debt was repaid by April 30, 2020. Change in Fair Value of Warrant Liability The increase of $14.7 million in the fair value of warrant liability for the nine months ended September 30, 2021 was the result of an increase in value of our redeemable convertible preferred stock warrant liability which is directly related to our stock valuation increase during the first quarter of 2021. Prior to our IPO, all outstanding warrants were exercised to purchase shares of our outstanding redeemable convertible preferred stock and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our outstanding redeemable convertible preferred stock, inclusive of the shares issued pursuant to these warrant exercises, converted into shares of Class B common stock. 38

Q3 2021 10Q Page 43 Page 45

Q3 2021 10Q Page 43 Page 45