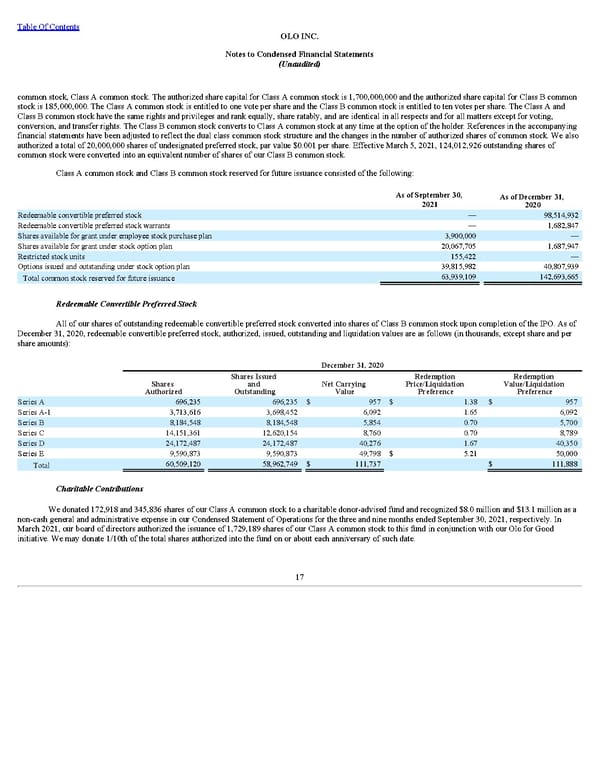

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) common stock, Class A common stock. The authorized share capital for Class A common stock is 1,700,000,000 and the authorized share capital for Class B common stock is 185,000,000. The Class A common stock is entitled to one vote per share and the Class B common stock is entitled to ten votes per share. The Class A and Class B common stock have the same rights and privileges and rank equally, share ratably, and are identical in all respects and for all matters except for voting, conversion, and transfer rights. The Class B common stock converts to Class A common stock at any time at the option of the holder. References in the accompanying financial statements have been adjusted to reflect the dual class common stock structure and the changes in the number of authorized shares of common stock. We also authorized a total of 20,000,000 shares of undesignated preferred stock, par value $0.001 per share. Effective March 5, 2021, 124,012,926 outstanding shares of common stock were converted into an equivalent number of shares of our Class B common stock. Class A common stock and Class B common stock reserved for future issuance consisted of the following: As of September 30, 2021 As of December 31, 2020 Redeemable convertible preferred stock — 98,514,932 Redeemable convertible preferred stock warrants — 1,682,847 Shares available for grant under employee stock purchase plan 3,900,000 — Shares available for grant under stock option plan 20,067,705 1,687,947 Restricted stock units 155,422 — Options issued and outstanding under stock option plan 39,815,982 40,807,939 Total common stock reserved for future issuance 63,939,109 142,693,665 Redeemable Convertible Preferred Stock All of our shares of outstanding redeemable convertible preferred stock converted into shares of Class B common stock upon completion of the IPO. As of December 31, 2020, redeemable convertible preferred stock, authorized, issued, outstanding and liquidation values are as follows (in thousands, except share and per share amounts): December 31, 2020 Shares Authorized Shares Issued and Outstanding Net Carrying Value Redemption Price/Liquidation Preference Redemption Value/Liquidation Preference Series A 696,235 696,235 $ 957 $ 1.38 $ 957 Series A-1 3,713,616 3,698,452 6,092 1.65 6,092 Series B 8,184,548 8,184,548 5,854 0.70 5,700 Series C 14,151,361 12,620,154 8,760 0.70 8,789 Series D 24,172,487 24,172,487 40,276 1.67 40,350 Series E 9,590,873 9,590,873 49,798 $ 5.21 50,000 Total 60,509,120 58,962,749 $ 111,737 $ 111,888 Charitable Contributions We donated 172,918 and 345,836 shares of our Class A common stock to a charitable donor-advised fund and recognized $8.0 million and $13.1 million as a non-cash general and administrative expense in our Condensed Statement of Operations for the three and nine months ended September 30, 2021, respectively. In March 2021, our board of directors authorized the issuance of 1,729,189 shares of our Class A common stock to this fund in conjunction with our Olo for Good initiative. We may donate 1/10th of the total shares authorized into the fund on or about each anniversary of such date. 17

Q3 2021 10Q Page 22 Page 24

Q3 2021 10Q Page 22 Page 24