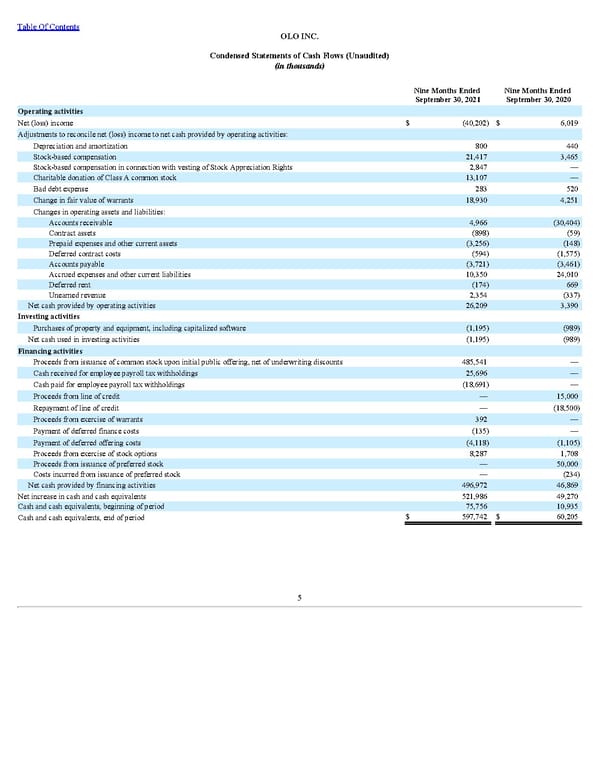

Table Of Contents OLO INC. Condensed Statements of Cash Flows (Unaudited) (in thousands) Nine Months Ended September 30, 2021 Nine Months Ended September 30, 2020 Operating activities Net (loss) income $ (40,202) $ 6,019 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization 800 440 Stock-based compensation 21,417 3,465 Stock-based compensation in connection with vesting of Stock Appreciation Rights 2,847 — Charitable donation of Class A common stock 13,107 — Bad debt expense 283 520 Change in fair value of warrants 18,930 4,251 Changes in operating assets and liabilities: Accounts receivable 4,966 (30,404) Contract assets (898) (59) Prepaid expenses and other current assets (3,256) (148) Deferred contract costs (594) (1,575) Accounts payable (3,721) (3,461) Accrued expenses and other current liabilities 10,350 24,010 Deferred rent (174) 669 Unearned revenue 2,354 (337) Net cash provided by operating activities 26,209 3,390 Investing activities Purchases of property and equipment, including capitalized software (1,195) (989) Net cash used in investing activities (1,195) (989) Financing activities Proceeds from issuance of common stock upon initial public offering, net of underwriting discounts 485,541 — Cash received for employee payroll tax withholdings 25,696 — Cash paid for employee payroll tax withholdings (18,691) — Proceeds from line of credit — 15,000 Repayment of line of credit — (18,500) Proceeds from exercise of warrants 392 — Payment of deferred finance costs (135) — Payment of deferred offering costs (4,118) (1,105) Proceeds from exercise of stock options 8,287 1,708 Proceeds from issuance of preferred stock — 50,000 Costs incurred from issuance of preferred stock — (234) Net cash provided by financing activities 496,972 46,869 Net increase in cash and cash equivalents 521,986 49,270 Cash and cash equivalents, beginning of period 75,756 10,935 Cash and cash equivalents, end of period $ 597,742 $ 60,205 5

Q3 2021 10Q Page 10 Page 12

Q3 2021 10Q Page 10 Page 12