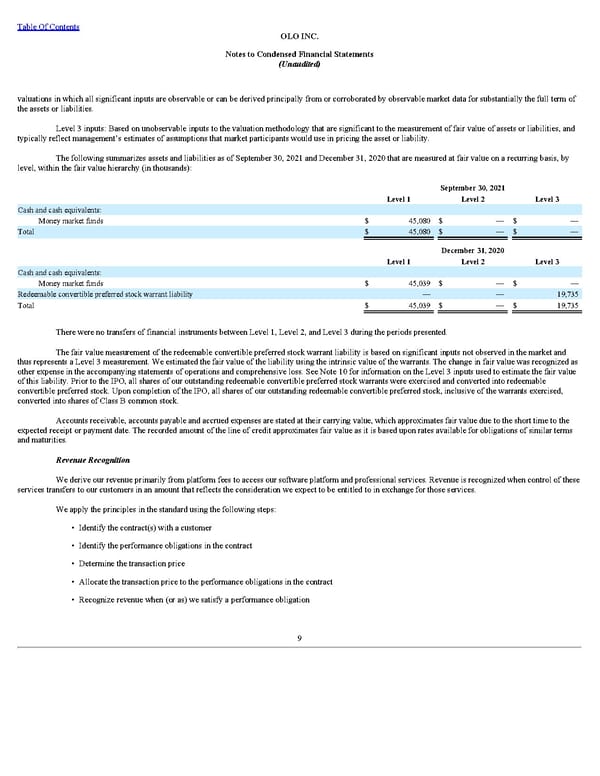

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 inputs: Based on unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities, and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The following summarizes assets and liabilities as of September 30, 2021 and December 31, 2020 that are measured at fair value on a recurring basis, by level, within the fair value hierarchy (in thousands): September 30, 2021 Level 1 Level 2 Level 3 Cash and cash equivalents: Money market funds $ 45,080 $ — $ — Total $ 45,080 $ — $ — December 31, 2020 Level 1 Level 2 Level 3 Cash and cash equivalents: Money market funds $ 45,039 $ — $ — Redeemable convertible preferred stock warrant liability — — 19,735 Total $ 45,039 $ — $ 19,735 There were no transfers of financial instruments between Level 1, Level 2, and Level 3 during the periods presented. The fair value measurement of the redeemable convertible preferred stock warrant liability is based on significant inputs not observed in the market and thus represents a Level 3 measurement. We estimated the fair value of the liability using the intrinsic value of the warrants. The change in fair value was recognized as other expense in the accompanying statements of operations and comprehensive loss. See Note 10 for information on the Level 3 inputs used to estimate the fair value of this liability. Prior to the IPO, all shares of our outstanding redeemable convertible preferred stock warrants were exercised and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our outstanding redeemable convertible preferred stock, inclusive of the warrants exercised, converted into shares of Class B common stock. Accounts receivable, accounts payable and accrued expenses are stated at their carrying value, which approximates fair value due to the short time to the expected receipt or payment date. The recorded amount of the line of credit approximates fair value as it is based upon rates available for obligations of similar terms and maturities. Revenue Recognition We derive our revenue primarily from platform fees to access our software platform and professional services. Revenue is recognized when control of these services transfers to our customers in an amount that reflects the consideration we expect to be entitled to in exchange for those services. We apply the principles in the standard using the following steps: • Identify the contract(s) with a customer • Identify the performance obligations in the contract • Determine the transaction price • Allocate the transaction price to the performance obligations in the contract • Recognize revenue when (or as) we satisfy a performance obligation 9

Q3 2021 10Q Page 14 Page 16

Q3 2021 10Q Page 14 Page 16