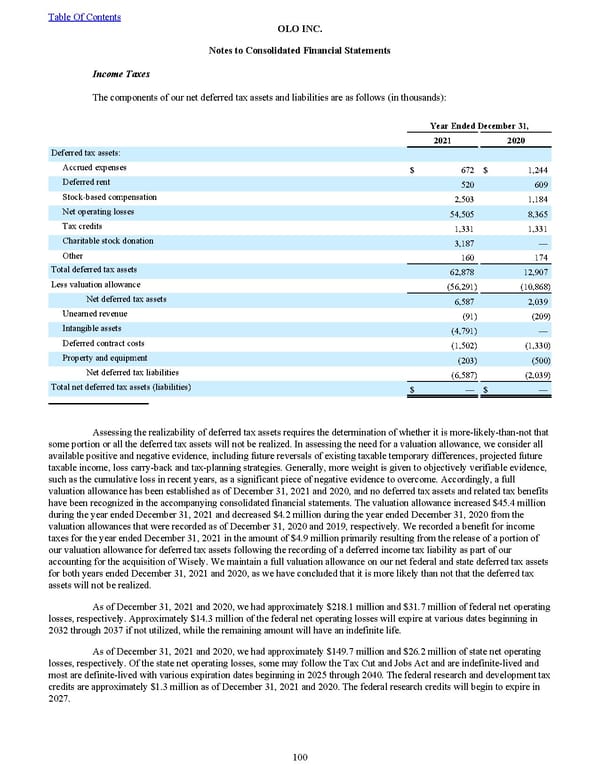

Income Taxes The components of our net deferred tax assets and liabilities are as follows (in thousands): Year Ended December 31, 2021 2020 Deferred tax assets: Accrued expenses $ 672 $ 1,244 Deferred rent 520 609 Stock-based compensation 2,503 1,184 Net operating losses 54,505 8,365 Tax credits 1,331 1,331 Charitable stock donation 3,187 — Other 160 174 Total deferred tax assets 62,878 12,907 Less valuation allowance (56,291) (10,868) Net deferred tax assets 6,587 2,039 Unearned revenue (91) (209) Intangible assets (4,791) — Deferred contract costs (1,502) (1,330) Property and equipment (203) (500) Net deferred tax liabilities (6,587) (2,039) Total net deferred tax assets (liabilities) $ — $ — Assessing the realizability of deferred tax assets requires the determination of whether it is more-likely-than-not that some portion or all the deferred tax assets will not be realized. In assessing the need for a valuation allowance, we consider all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, loss carry-back and tax-planning strategies. Generally, more weight is given to objectively verifiable evidence, such as the cumulative loss in recent years, as a significant piece of negative evidence to overcome. Accordingly, a full valuation allowance has been established as of December 31, 2021 and 2020 , and no deferred tax assets and related tax benefits have been recognized in the accompanying consolidated financial statements. The valuation allowance increased $45.4 million during the year ended December 31, 2021 and decreased $4.2 million during the year ended December 31, 2020 from the valuation allowances that were recorded as of December 31, 2020 and 2019 , respectively. We recorded a benefit for income taxes for the year ended December 31, 2021 in the amount of $4.9 million primarily resulting from the release of a portion of our valuation allowance for deferred tax assets following the recording of a deferred income tax liability as part of our accounting for the acquisition of Wisely. We maintain a full valuation allowance on our net federal and state deferred tax assets for both years ended December 31, 2021 and 2020, as we have concluded that it is more likely than not that the deferred tax assets will not be realized. As of December 31, 2021 and 2020 , we had approximately $218.1 million and $31.7 million of federal net operating losses, respectively. Approximately $14.3 million of the federal net operating losses will expire at various dates beginning in 2032 through 2037 if not utilized, while the remaining amount will have an indefinite life. As of December 31, 2021 and 2020 , we had approximately $149.7 million and $26.2 million of state net operating losses, respectively. Of the state net operating losses, some may follow the Tax Cut and Jobs Act and are indefinite-lived and most are definite-lived with various expiration dates beginning in 2025 through 2040. The federal research and development tax credits are approximately $1.3 million as of December 31, 2021 and 2020 . The federal research credits will begin to expire in 2027. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 100

2022 10K Page 106 Page 108

2022 10K Page 106 Page 108