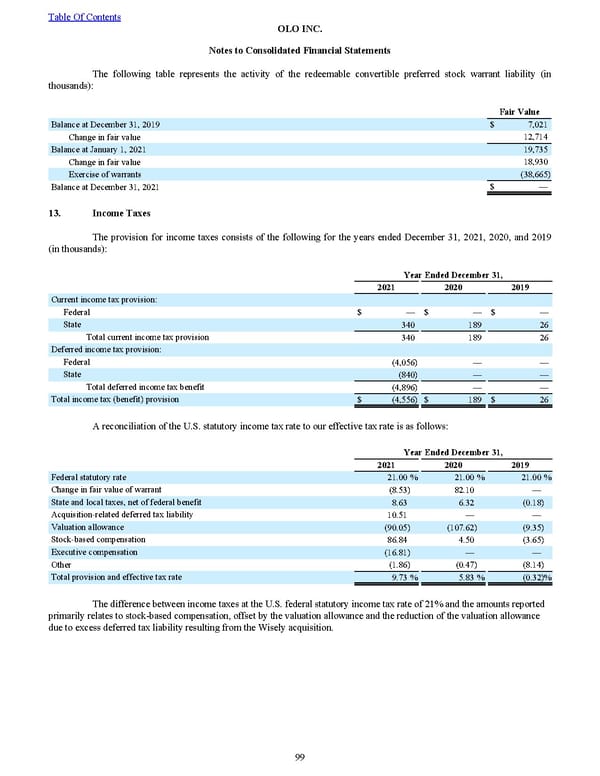

The fol lowing table represents the activity of the redeemable convertible preferred stock warrant liability (in thousands): Fair Value Balance at December 31, 2019 $ 7,021 Change in fair value 12,714 Balance at January 1, 2021 19,735 Change in fair value 18,930 Exercise of warrants (38,665) Balance at December 31, 2021 $ — 13. Income Taxes The provision for income taxes consists of the following for the years ended December 31, 2021 , 2020 , and 2019 (in thousands): Year Ended December 31, 2021 2020 2019 Current income tax provision: Federal $ — $ — $ — State 340 189 26 Total current income tax provision 340 189 26 Deferred income tax provision: Federal (4,056) — — State (840) — — Total deferred income tax benefit (4,896) — — Total income tax (benefit) provision $ (4,556) $ 189 $ 26 A reconciliation of the U.S. statutory income tax rate to our effective tax rate is as follows: Year Ended December 31, 2021 2020 2019 Federal statutory rate 21.00 % 21.00 % 21.00 % Change in fair value of warrant (8.53) 82.10 — State and local taxes, net of federal benefit 8.63 6.32 (0.18) Acquisition-related deferred tax liability 10.51 — — Valuation allowance (90.05) (107.62) (9.35) Stock-based compensation 86.84 4.50 (3.65) Executive compensation (16.81) — — Other (1.86) (0.47) (8.14) Total provision and effective tax rate 9.73 % 5.83 % (0.32) % The difference between income taxes at the U.S. federal statutory income tax rate of 21% and the amounts reported primarily relates to stock-based compensation, offset by the valuation allowance and the reduction of the valuation allowance due to excess deferred tax liability resulting from the Wisely acquisition. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 99

2022 10K Page 105 Page 107

2022 10K Page 105 Page 107