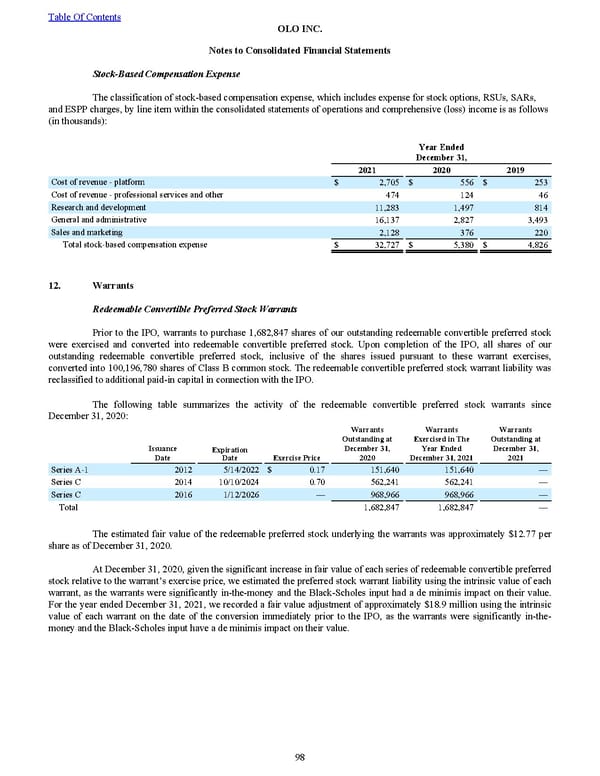

Stock-Based Compensation Expense The classification of stock-based compensation expense , which includes expense for stock options, RSUs, SARs, and ESPP charges, by line item within the consolidated statements of operations and comprehensive (l oss ) income is as follows (in thousands): Year Ended December 31, 2021 2020 2019 Cost of revenue - platform $ 2,705 $ 556 $ 253 Cost of revenue - professional services and other 474 124 46 Research and development 11,283 1,497 814 General and administrative 16,137 2,827 3,493 Sales and marketing 2,128 376 220 Total stock-based compensation expense $ 32,727 $ 5,380 $ 4,826 12. Warrants Redeemable Convertible Preferred Stock Warrants Prior to the IPO, warrants to purchase 1,682,847 shares of our outstanding redeemable convertible preferred stock were exercised and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our outstanding redeemable convertible preferred stock, inclusive of the shares issued pursuant to these warrant exercises, converted into 100,196,780 shares of Class B common stock. The redeemable convertible preferred stock warrant liability was reclassified to additional paid-in capital in connection with the IPO. The following table summarizes the activity of the redeemable convertible preferred stock warrants since December 31, 2020 : Issuance Date Expiration Date Exercise Price Warrants Outstanding at December 31, 2020 Warrants Exercised in The Year Ended December 31, 2021 Warrants Outstanding at December 31, 2021 Series A-1 2012 5/14/2022 $ 0.17 151,640 151,640 — Series C 2014 10/10/2024 0.70 562,241 562,241 — Series C 2016 1/12/2026 — 968,966 968,966 — Total 1,682,847 1,682,847 — The estimated fair value of the redeemable preferred stock underlying the warrants was approximately $12.77 per share as of December 31, 2020 . At December 31, 2020 , given the significant increase in fair value of each series of redeemable convertible preferred stock relative to the warrant’s exercise price, we estimated the preferred stock warrant liability using the intrinsic value of each warrant, as the warrants were significantly in-the-money and the Black-Scholes input had a de minimis impact on their value . For the year ended December 31, 2021 , we recorded a fair value adjustment of approximately $18.9 million using the intrinsic value of each warrant on the date of the conversion immediately prior to the IPO, as the warrants were significantly in-the- money a nd the Black-Scholes input have a de minimis impact on their value . Table Of Contents OLO INC. Notes to Consolidated Financial Statements 98

2022 10K Page 104 Page 106

2022 10K Page 104 Page 106