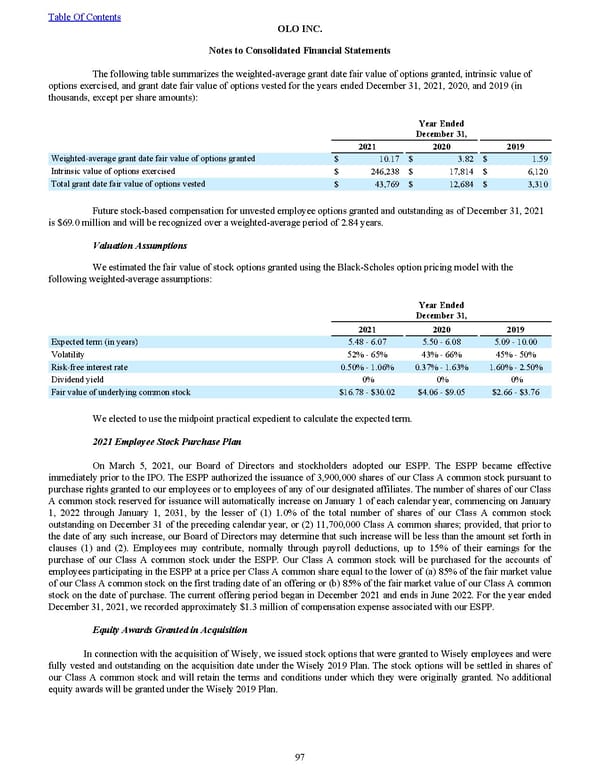

The following table summarizes the weighted-average grant date fair value of options granted, intrinsic value of options exercised, and grant date fair value of options vested for the years ended December 31, 2021 , 2020 , and 2019 (in thousands, except per share amounts) : Year Ended December 31, 2021 2020 2019 Weighted-average grant date fair value of options granted $ 10.17 $ 3.82 $ 1.59 Intrinsic value of options exercised $ 246,238 $ 17,814 $ 6,120 Total grant date fair value of options vested $ 43,769 $ 12,684 $ 3,310 Future stock-based compensation for unvested employee options granted and outstanding as of December 31, 2021 is $69.0 million and will be recognized over a weighted-average period of 2.84 years . Valuation Assumptions We estimated the fair value of stock options granted using the Black-Scholes option pricing model with the following weighted-average assumptions: Year Ended December 31, 2021 2020 2019 Expected term (in years) 5.48 - 6.07 5.50 - 6.08 5.09 - 10.00 Volatility 52% - 65% 43% - 66% 45% - 50% Risk-free interest rate 0.50% - 1.06% 0.37% - 1.63% 1.60% - 2.50% Dividend yield 0% 0% 0% Fair value of underlying common stock $16.78 - $30.02 $4.06 - $9.05 $2.66 - $3.76 We elected to use the midpoint practical expedient to calculate the expected term. 2021 Employee Stock Purchase Plan On March 5, 2021, our Board of Directors and stockholders adopted our ESPP. The ESPP became effective immediately prior to the IPO. The ESPP authorized the issuance of 3,900,000 shares of our Class A common stock pursuant to purchase rights granted to our employees or to employees of any of our designated affiliates. The number of shares of our Class A common stock reserved for issuance will automatically increase on January 1 of each calendar year, commencing on January 1, 2022 through January 1, 2031, by the lesser of (1) 1.0% of the total number of shares of our Class A common stock outstanding on December 31 of the preceding calendar year, or (2) 11,700,000 Class A common shares; provided, that prior to the date of any such increase, our Board of Directors may determine that such increase will be less than the amount set forth in clauses (1) and (2). Employees may contribute, normally through payroll deductions, up to 15% of their earnings for the purchase of our Class A common stock under the ESPP. Our Class A common stock will be purchased for the accounts of employees participating in the ESPP at a price per Class A common share equal to the lower of (a) 85% of the fair market value of our Class A common stock on the first trading date of an offering or (b) 85% of the fair market value of our Class A common stock on the date of purchase. The current offering period began in December 2021 and ends in June 2022. For the year ended December 31, 2021 , we recorded approximately $1.3 million of compensation expense associated with our ESPP. Equity Awards Granted in Acquisition In connection with the acquisition of Wisely, we issued stock options that were granted to Wisely employees and were fully vested and outstanding on the acquisition date under the Wisely 2019 Plan. The stock options will be settled in shares of our Class A common stock and will retain the terms and conditions under which they were originally granted. No additional equity awards will be granted under the Wisely 2019 Plan. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 97

2022 10K Page 103 Page 105

2022 10K Page 103 Page 105