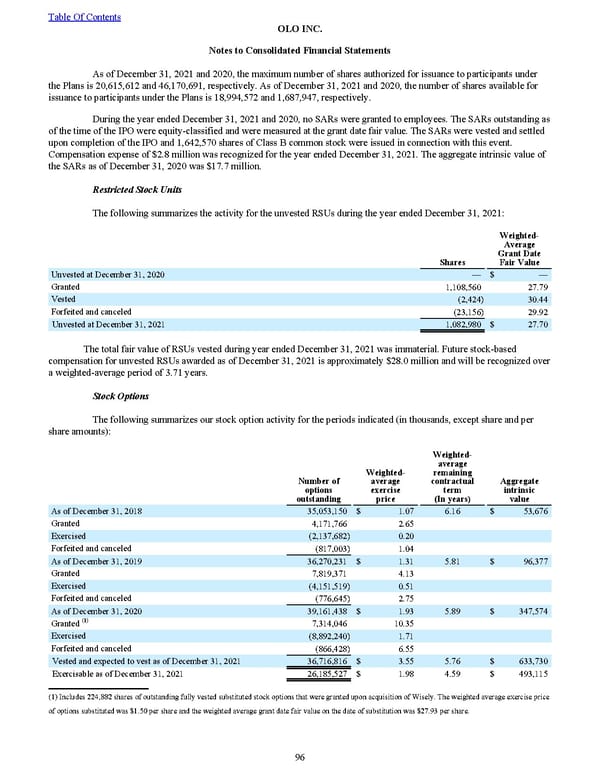

As of December 31, 2021 and 2020 , the maximum number of shares authorized for issuance to participants under the Plans is 20,615,612 and 46,170,691 , respectively. As of December 31, 2021 and 2020 , the number of shares available for issuance to participants under the Plans is 18,994,572 and 1,687,947 , respectively. During the year ended December 31, 2021 and 2020 , no SARs were granted to employees. The SARs outstanding as of the time of the IPO were equity-classified and were measured at the grant date fair value. The SARs were vested and settled upon completion of the IPO and 1,642,570 shares of Class B common stock were issued in connection with this event. Compensation expense of $2.8 million was recognized for the year ended December 31, 2021 . The aggregate intrinsic value of the SARs as of December 31, 2020 was $17.7 million . Restricted Stock Units The following summarizes the activity for the unvested RSUs during the year ended December 31, 2021 : Shares Weighted- Average Grant Date Fair Value Unvested at December 31, 2020 — $ — Granted 1,108,560 27.79 Vested (2,424) 30.44 Forfeited and canceled (23,156) 29.92 Unvested at December 31, 2021 1,082,980 $ 27.70 The total fair value of RSUs vested during year ended December 31, 2021 was immaterial . Future stock-based compensation for unvested RSUs awarded as of December 31, 2021 is approximately $28.0 million and will be recognized over a weighted-average period of 3.71 years . Stock Options The following summarizes our stock option activity for the periods indicated (in thousands, except share and per share amounts) : Number of options outstanding Weighted- average exercise price Weighted- average remaining contractual term (In years) Aggregate intrinsic value As of December 31, 2018 35,053,150 $ 1.07 6.16 $ 53,676 Granted 4,171,766 2.65 Exercised (2,137,682) 0.20 Forfeited and canceled (817,003) 1.04 As of December 31, 2019 36,270,231 $ 1.31 5.81 $ 96,377 Granted 7,819,371 4.13 Exercised (4,151,519) 0.51 Forfeited and canceled (776,645) 2.75 As of December 31, 2020 39,161,438 $ 1.93 5.89 $ 347,574 Granted (1) 7,314,046 10.35 Exercised (8,892,240) 1.71 Forfeited and canceled (866,428) 6.55 Vested and expected to vest as of December 31, 2021 36,716,816 $ 3.55 5.76 $ 633,730 Exercisable as of December 31, 2021 26,185,527 $ 1.98 4.59 $ 493,115 (1) Includes 224,882 shares of outstanding fully vested substituted stock options that were granted upon acquisition of Wisely. The weighted average exercise price of options substituted was $1.50 per share and the weighted average grant date fair value on the date of substitution was $27.93 per share. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 96

2022 10K Page 102 Page 104

2022 10K Page 102 Page 104