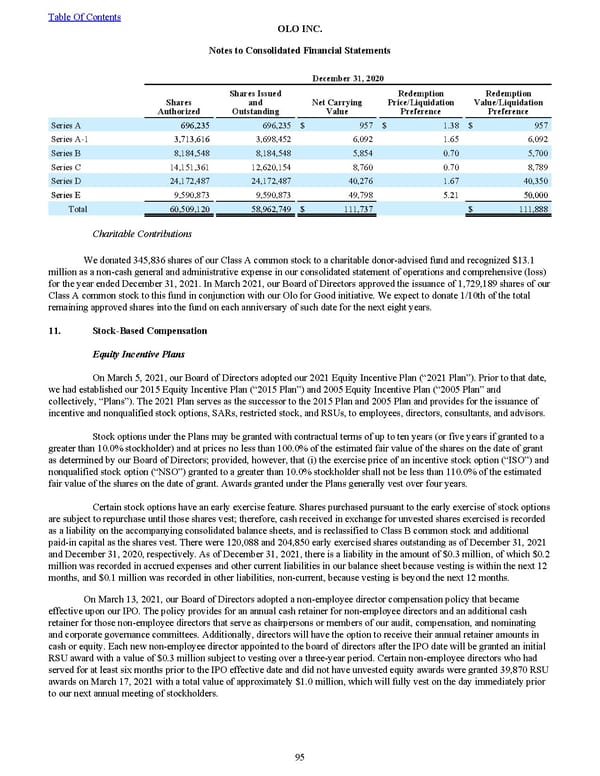

December 31, 2020 Shares Authorized Shares Issued and Outstanding Net Carrying Value Redemption Price/Liquidation Preference Redemption Value/Liquidation Preference Series A 696,235 696,235 $ 957 $ 1.38 $ 957 Series A-1 3,713,616 3,698,452 6,092 1.65 6,092 Series B 8,184,548 8,184,548 5,854 0.70 5,700 Series C 14,151,361 12,620,154 8,760 0.70 8,789 Series D 24,172,487 24,172,487 40,276 1.67 40,350 Series E 9,590,873 9,590,873 49,798 5.21 50,000 Total 60,509,120 58,962,749 $ 111,737 $ 111,888 Charitable Contributions We donated 345,836 shares of our Class A common stock to a charitable donor-advised fund and recognized $13.1 million as a non-cash general and administrative expense in our consolidated statement of operations and comprehensive (loss) for the year ended December 31, 2021 . In March 2021, our Board of Directors approved the issuance of 1,729,189 shares of our Class A common stock to this fund in conjunction with our Olo for Good initiative. We expect to donate 1/10th of the total remaining approved shares into the fund on each anniversary of such date for the next eight years. 11. Stock-Based Compensation Equity Incentive Plans On March 5, 2021, our Board of Directors adopted our 2021 Equity Incentive Plan (“2021 Plan”). Prior to that date, we had established our 2015 Equity Incentive Plan (“2015 Plan”) and 2005 Equity Incentive Plan (“2005 Plan” and collectively, “Plans”). The 2021 Plan serves as the successor to the 2015 Plan and 2005 Plan and provides for the issuance of incentive and nonqualified stock options, SARs, restricted stock, and RSUs, to employees, directors, consultants, and advisors. Stock options under the Plans may be granted with contractual terms of up to ten years (or five years if granted to a greater than 10.0% stockholder) and at prices no less than 100.0% of the estimated fair value of the shares on the date of grant as determined by our Board of Directors; provided, however, that (i) the exercise price of an incentive stock option (“ISO”) and nonqualified stock option (“NSO”) granted to a greater than 10.0% stockholder shall not be less than 110.0% of the estimated fair value of the shares on the date of grant. Awards granted under the Plans generally vest over four years . Certain stock options have an early exercise feature. Shares purchased pursuant to the early exercise of stock options are subject to repurchase until those shares vest; therefore, cash received in exchange for unvested shares exercised is recorded as a liability on the accompanying consolidated balance sheets, and is reclassified to Class B common stock and additional paid-in capital as the shares vest. There were 120,088 and 204,850 early exercised shares outstanding as of December 31, 2021 and December 31, 2020 , respectively. As of December 31, 2021 , there is a liability in the amount of $0.3 million , of which $0.2 million was recorded in accrued expenses and other current liabilities in our balance sheet because vesting is within the next 12 months, and $0.1 million was recorded in other liabilities, non-current, because vesting is beyond the next 12 months. On March 13, 2021, our Board of Directors adopted a non-employee director compensation policy that became effective upon our IPO. The policy provides for an annual cash retainer for non-employee directors and an additional cash retainer for those non-employee directors that serve as chairpersons or members of our audit, compensation, and nominating and corporate governance committees. Additionally, directors will have the option to receive their annual retainer amounts in cash or equity. Each new non-employee director appointed to the board of directors after the IPO date will be granted an initial RSU award with a value of $0.3 million subject to vesting over a three -year period. Certain non-employee directors who had served for at least six months prior to the IPO effective date and did not have unvested equity awards were granted 39,870 RSU awards on March 17, 2021 with a total value of approximately $1.0 million , which will fully vest on the day immediately prior to our next annual meeting of stockholders. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 95

2022 10K Page 101 Page 103

2022 10K Page 101 Page 103