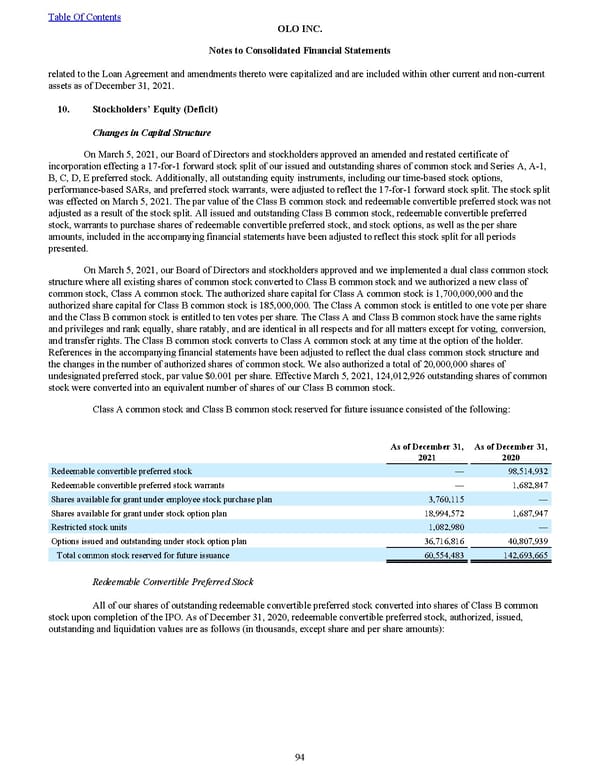

related to the Loan Agreement and amendments thereto were capitalized and are included within other current and non-current assets as of December 31, 2021 . 10. Stockholders’ Equit y (Deficit) Changes in Capital Structure On March 5, 2021 , our Board of Directors and stockholders approved an amended and restated certificate of incorporation effecting a 17 -for-1 forward stock split of our issued and outstanding shares of common stock and Series A, A-1, B, C, D, E preferred stock. Additionally, all outstanding equity instruments, including our time-based stock options, performance-based SARs, and preferred stock warrants, were adjusted to reflect the 17 -for-1 forward stock split. The stock split was effected on March 5, 2021 . The par value of the Class B common stock and redeemable convertible preferred stock was not adjusted as a result of the stock split. All issued and outstanding Class B common stock, redeemable convertible preferred stock, warrants to purchase shares of redeemable convertible preferred stock, and stock options, as well as the per share amounts, included in the accompanying financial statements have been adjusted to reflect this stock split for all periods presented. On March 5, 2021 , our Board of Directors and stockholders approved and we implemented a dual class common stock structure where all existing shares of common stock converted to Class B common stock and we authorized a new class of common stock, Class A common stock. The authorized share capital for Class A common stock is 1,700,000,000 and the authorized share capital for Class B common stock is 185,000,000 . The Class A common stock is entitled to one vote per share and the Class B common stock is entitled to ten votes per share. The Class A and Class B common stock have the same rights and privileges and rank equally, share ratably, and are identical in all respects and for all matters except for voting, conversion, and transfer rights. The Class B common stock converts to Class A common stock at any time at the option of the holder. References in the accompanying financial statements have been adjusted to reflect the dual class common stock structure and the changes in the number of authorized shares of common stock. We also authorized a total of 20,000,000 shares of undesignated preferred stock, par value $0.001 per share. Effective March 5, 2021, 124,012,926 outstanding shares of common stock were converted into an equivalent number of shares of our Class B common stock. Class A common stock and Class B common stock reserved for future issuance consisted of the following: As of December 31, 2021 As of December 31, 2020 Redeemable convertible preferred stock — 98,514,932 Redeemable convertible preferred stock warrants — 1,682,847 Shares available for grant under employee stock purchase plan 3,760,115 — Shares available for grant under stock option plan 18,994,572 1,687,947 Restricted stock units 1,082,980 — Options issued and outstanding under stock option plan 36,716,816 40,807,939 Total common stock reserved for future issuance 60,554,483 142,693,665 Redeemable Convertible Preferred Stock All of our shares of outstanding redeemable convertible preferred stock converted into shares of Class B common stock upon completion of the IPO. As of December 31, 2020 , redeemable convertible preferred stock, authorized, issued, outstanding and liquidation values are as follows (in thousands, except share and per share amounts): Table Of Contents OLO INC. Notes to Consolidated Financial Statements 94

2022 10K Page 100 Page 102

2022 10K Page 100 Page 102