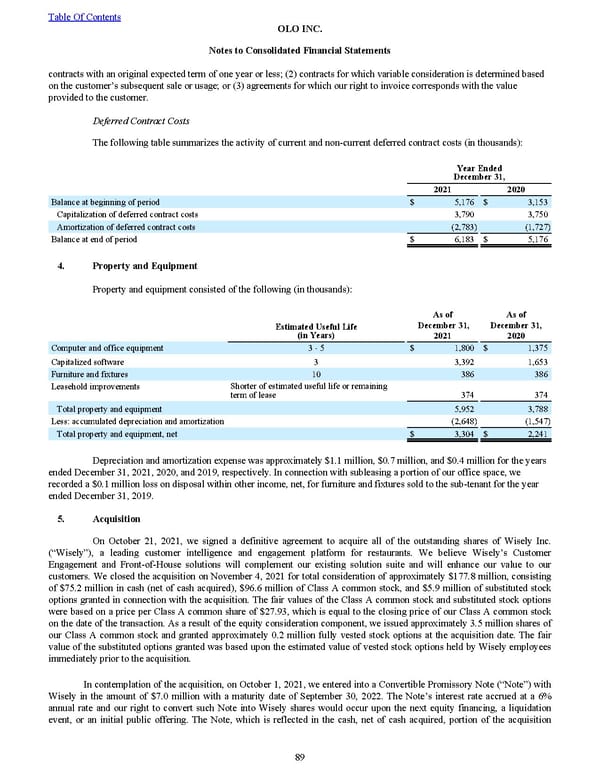

contracts with an original expected term of one year or less; (2) contracts for which variable consideration is determined based on the customer’s subsequent sale or usage; or (3) agreements for which our right to invoice corresponds with the value provided to the customer. Deferred Contract Costs The following table summarizes the activity of current and non-current deferred contract costs (in t housands): Year Ended December 31, 2021 2020 Balance at beginning of period $ 5,176 $ 3,153 Capitalization of deferred contract costs 3,790 3,750 Amortization of deferred contract costs (2,783) (1,727) Balance at end of period $ 6,183 $ 5,176 4. Property and Equipment Property and equipment consisted of the following (in thousands): Estimated Useful Life (in Years) As of December 31, 2021 As of December 31, 2020 Computer and office equipment 3 - 5 $ 1,800 $ 1,375 Capitalized software 3 3,392 1,653 Furniture and fixtures 10 386 386 Leasehold improvements Shorter of estimated useful life or remaining term of lease 374 374 Total property and equipment 5,952 3,788 Less: accumulated depreciation and amortization (2,648) (1,547) Total property and equipment, net $ 3,304 $ 2,241 Depreciation and amortization expense was approximately $1.1 million , $0.7 million , and $0.4 million for the years ended December 31, 2021 , 2020 , and 2019 , respectively. In connection with subleasing a portion of our office space, we recorded a $0.1 million loss on disposal within other income, net, for furniture and fixtures sold to the sub-tenant for the year ended December 31, 2019 . 5. Acquisition On October 21, 2021, we signed a definitive agreement to acquire all of the outstanding shares of Wisely Inc. ( “Wisely” ), a leading customer intelligence and engagement platform for restaurants. We believe Wisely’s Customer Engagement and F ront -of-House solutions will complement our existing solution suite and will enhance our value to our customers. W e closed the acquisition on November 4, 2021 for total consideration of approximately $177.8 million , consisting of $75.2 million in cash (net of cash acquired), $96.6 million of Class A common stock, and $5.9 million of substituted stock options granted in connection with the acquisition. The fair values of the Class A common stock and substituted stock options w ere based on a price per Class A common share of $27.93 , which is equal to the closing price of our Class A common stock on the date of the transaction . As a result of the equity consideration component, we issued approximately 3.5 million shares of our Class A common stock and granted approximately 0.2 million fully vested stock options at the acquisition date. The fair value of the substituted options granted was based upon the estimated value of vested stock options held by Wisely employees immediately prior to the acquisition . In contemplation of the acquisition, on October 1, 2021, we entered into a Convertible Promissory Note (“Note”) with Wisely in the amount of $7.0 million with a maturity date of September 30, 2022. The Note’s interest rate accrued at a 6% annual rate and our right to convert such Note into Wisely shares would occur upon the next equity financing, a liquidation event, or an initial public offering. The Note, which is reflected in the cash, net of cash acquired, portion of the acquisition Table Of Contents OLO INC. Notes to Consolidated Financial Statements 89

2022 10K Page 95 Page 97

2022 10K Page 95 Page 97