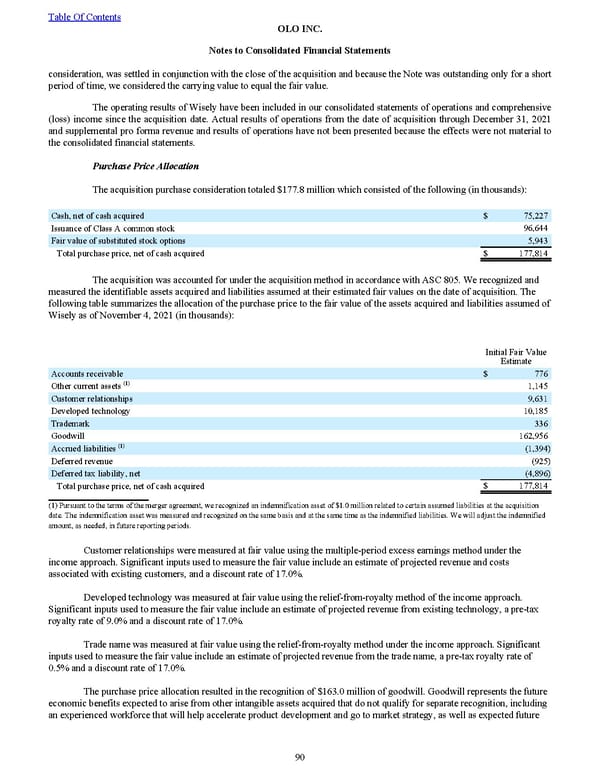

consideration, was settled in conjunction with the close of the acquisition and because the Note was outstanding only for a short period of time, we considered the carrying value to equal the fair value. The operating results of Wisely have been included in our consolidated statements of operations and comprehensive (loss) income since the acquisition date. Actual results of operations from the date of acquisition through December 31, 2021 and supplemental pro forma revenue and results of operations have not been presented because the effects were not material to the consolidated financial statements. Purchas e Price Allocation The acquisition purchase consideration totaled $177.8 million which consisted of the following (in thousands): Cash, net of cash acquired $ 75,227 Issuance of Class A common stock 96,644 Fair value of substituted stock options 5,943 Total purchase price, net of cash acquired $ 177,814 The acquisition was accounted for under the acquisition method in accordance with ASC 805. We recognized and measured the identifiable assets acquired and liabilities assumed at their estimated fair values on the date of acquisition. The following table summarizes the allocation of the purchase price to the fair value of the assets acquired and liabilities assumed of Wisely as of November 4, 2021 (in thousands): Initial Fair Value Estimate Accounts receivable $ 776 Other current assets (1) 1,145 Customer relationships 9,631 Developed technology 10,185 Trademark 336 Goodwill 162,956 Accrued liabilities (1) (1,394) Deferred revenue (925) Deferred tax liability, net (4,896) Total purchase price, net of cash acquired $ 177,814 (1) Pursuant to the terms of the merger agreement, we recognized an indemnification asset of $1.0 million related to certain assumed liabilities at the acquisition date. The indemnification asset was measured and recognized on the same basis and at the same time as the indemnified liabilities. We will adjust the indemnified amount, as needed, in future reporting periods. Customer relationships were measured at fair value using the multiple-period excess earnings method under the income approach. Significant inputs used to measure the fair value include an estimate of projected revenue and costs associated with existing customers, and a discount rate of 17.0% . Developed technology was measured at fair value using the relief-from-royalty method of the income approach. Significant inputs used to measure the fair value include an estimate of projected revenue from existing technology, a pre-tax royalty rate of 9.0% and a discount rate of 17.0% . Trade name was measured at fair value using the relief-from-royalty method under the income approach. Significant inputs used to measure the fair value include an estimate of projected revenue from the trade name, a pre-tax royalty rate of 0.5% and a discount rate of 17.0% . The purchase price allocation resulted in the recognition of $163.0 million of goodwill. Goodwill represents the future economic benefits expected to arise from other intangible assets acquired that do not qualify for separate recognition, including an experienced workforce that will help accelerate product development and go to market strategy, as well as expected future Table Of Contents OLO INC. Notes to Consolidated Financial Statements 90

2022 10K Page 96 Page 98

2022 10K Page 96 Page 98