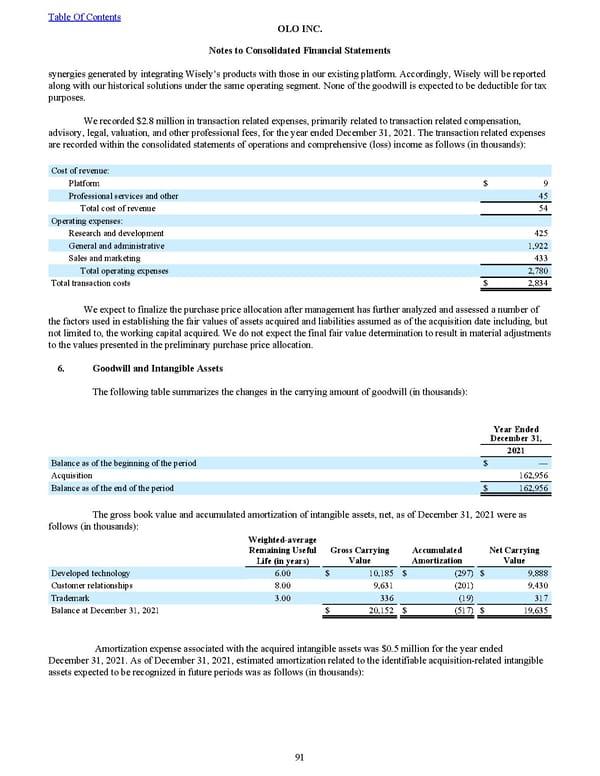

synergies generated by integrating Wisely’s products with those in our existing platform. Accordingly, Wisely will be reported along with our historical solutions under the same operating segment . None of the goodwill is expected to be deductible for tax purposes. We recorded $2.8 million in transaction related expenses, primarily related to transaction related compensation, advisory, legal, valuation, and other professional fees, for the year ended December 31, 20 21. The transaction related expe nses are recorded within the consolidated statements of operations and comprehensive (loss) income as follows (in thousands) : Cost of revenue: Platform $ 9 Professional services and other 45 Total cost of revenue 54 Operating expenses: Research and development 425 General and administrative 1,922 Sales and marketing 433 Total operating expenses 2,780 Total transaction costs $ 2,834 We expect to finalize the purchase price allocation after management has further analyzed and assessed a number of the factors used in establishing the fair values of assets acquired and liabilities assumed as of the acquisition date including, but not limited to, the working capital acquired. We do not expect the final fair value determination to result in material adjustments to the values presented in the preliminary purchase price allocation. 6. Goodwill and Intangible Assets The following table summarizes the changes in the carrying amount of goodwill (in thousands): Year Ended December 31, 2021 Balance as of the beginning of the period $ — Acquisition 162,956 Balance as of the end of the period $ 162,956 The gross book value and accumulated amortization of intangible assets, net, as of December 31, 2021 were as follows (in thousands): Weighted-average Remaining Useful Life (in years) Gross Carrying Value Accumulated Amortization Net Carrying Value Developed technology 6.00 $ 10,185 $ (297) $ 9,888 Customer relationships 8.00 9,631 (201) 9,430 Trademark 3.00 336 (19) 317 Balance at December 31, 2021 $ 20,152 $ (517) $ 19,635 Amortization expense associated with the acquired intangible assets was $0.5 million for the year ended December 31, 2021 . As of December 31, 2021 , estimated amortization related to the identifiable acquisition-related intangible assets expected to be recognized in future periods was as follows (in thousands): Table Of Contents OLO INC. Notes to Consolidated Financial Statements 91

2022 10K Page 97 Page 99

2022 10K Page 97 Page 99