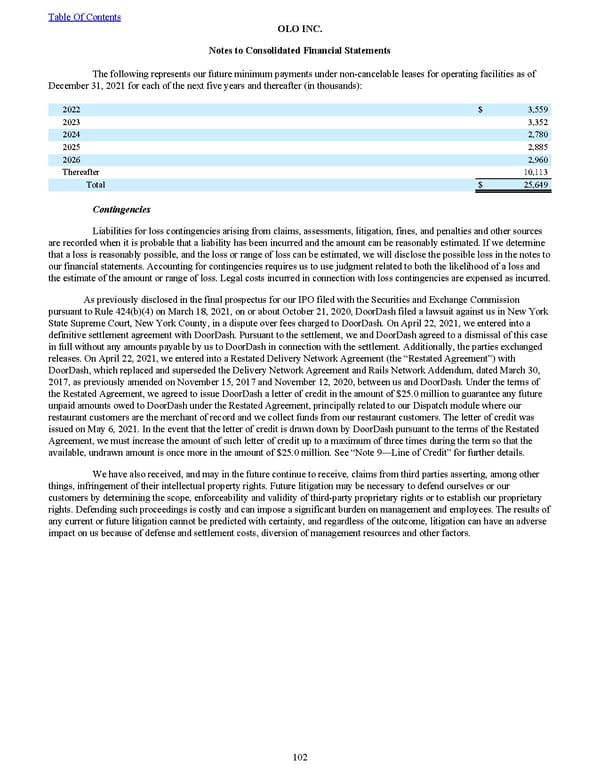

The following represents our future minimum payments under non-cancelable leases for operating facilities as of December 31, 2021 for each of the next five years and thereafter (in th ousands): 2022 $ 3,559 2023 3,352 2024 2,780 2025 2,885 2026 2,960 Thereafter 10,113 Total $ 25,649 Contingencies Liabilities for loss contingencies arising from claims, assessments, litigation, fines, and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount can be reasonably estimated. If we determine that a loss is reasonably possible, and the loss or range of loss can be estimated, we will disclose the possible loss in the notes to our financial statements. Accounting for contingencies requires us to use judgment related to both the likelihood of a loss and the estimate of the amount or range of loss. Legal costs incurred in connection with loss contingencies are expensed as incurred. As previously disclosed in the final prospectus for our IPO filed with the Securities and Exchange Commission pursuant to Rule 424(b)(4) on March 18, 2021, on or about October 21, 2020, DoorDash filed a lawsuit against us in New York State Supreme Court, New York County, in a dispute over fees charged to DoorDash. On April 22, 2021, we entered into a definitive settlement agreement with DoorDash. Pursuant to the settlement, we and DoorDash agreed to a dismissal of this case in full without any amounts payable by us to DoorDash in connection with the settlement. Additionally, t he parties exchanged releases. On April 22, 2021, we entered into a Restated Delivery Network Agreement (the “Restated Agreement”) with DoorDash, which replaced and superseded the Delivery Network Agreement and Rails Network Addendum, dated March 30, 2017, as previously amended on November 15, 2017 and November 12, 2020, between us and DoorDash. Under the terms of the Restated Agreement, we agreed to issue DoorDash a letter of credit in the amount of $25.0 million to guarantee any future unpaid amounts owed to DoorDash under the Restated Agreement, principally related to our Dispatch module where our restaurant customers are the merchant of record and we collect funds from our restaurant customers. The letter of credit was issued on May 6, 2021. In the event that the letter of credit is drawn down by DoorDash pursuant to the terms of the Restated Agreement, we must increase the amount of such letter of credit up to a maximum of three times during the term so that the available, undrawn amount is once more in the amount of $25.0 million . See “Note 9 — Line of Credit” for further details. We have also received, and may in the future continue to receive, claims from third parties asserting, among other things, infringement of their intellectual property rights. Future litigation may be necessary to defend ourselves or our customers by determining the scope, enforceability and validity of third-party proprietary rights or to establish our proprietary rights. Defending such proceedings is costly and can impose a significant burden on management and employees. The results of any current or future litigation cannot be predicted with certainty, and regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors. Table Of Contents OLO INC. Notes to Consolidated Financial Statements 102

2022 10K Page 108 Page 110

2022 10K Page 108 Page 110