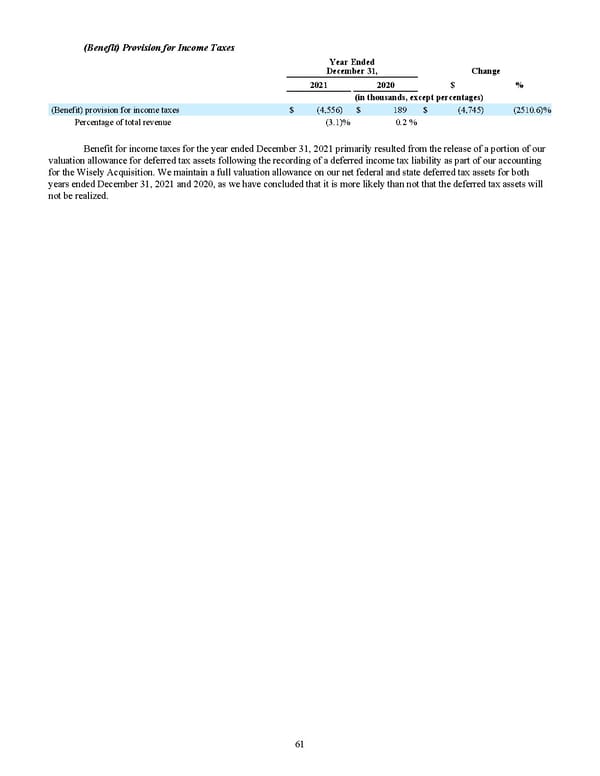

(Benefit) Provision for Income Taxes Year Ended December 31, Change 2021 2020 $ % (in thousands, except percentages) (Benefit) provision for income taxes $ (4,556) $ 189 $ (4,745) (2510.6) % Percentage of total revenue (3.1) % 0.2 % Bene fit for income taxes for the year ended December 31, 2021 primarily resulted from the release of a portion of our valuation allowance for deferred tax assets following the recording of a deferred income tax liability as part of our accounting for the Wisely Acquisition . We maintain a full valuation allowance on our net federal and state deferred tax assets for both years ended December 31, 2021 and 2020, as we have concluded that it is more likely than not that the deferred tax assets will not be realized. 61

2022 10K Page 67 Page 69

2022 10K Page 67 Page 69