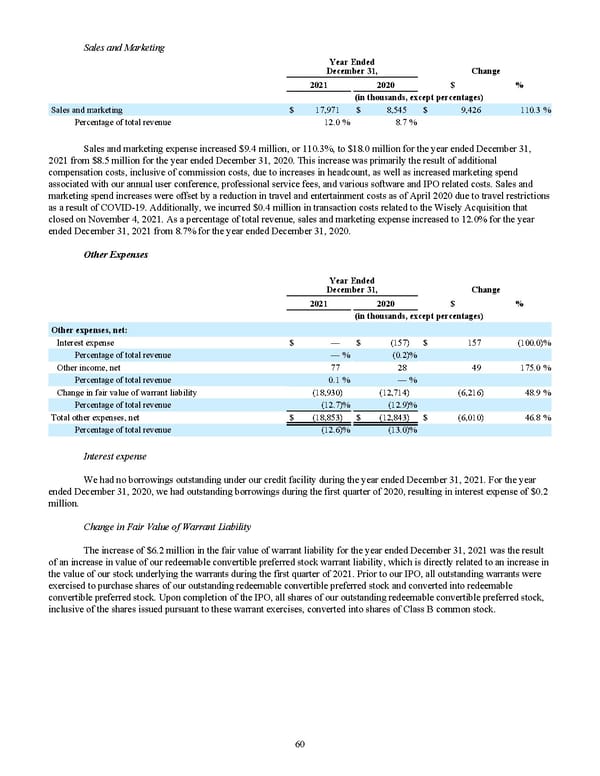

Sales and Marketing Year Ended December 31, Change 2021 2020 $ % (in thousands, except percentages) Sales and marketing $ 17,971 $ 8,545 $ 9,426 110.3 % Percentage of total revenue 12.0 % 8.7 % Sales and marketing expense increased $9.4 million , or 110.3% , to $18.0 million for the year ended December 31, 2021 from $8.5 million for the year ended December 31, 2020 . This increase was primarily the result of additional compensation costs, inclusive of commission costs, due to increases in headcount, as well as increased marketing spend associated with our annual user conference, professional service fees, and various software and IPO related costs. Sales and marketing spend increases were offset by a reduction in travel and entertainment costs as of April 2020 due to travel restrictions as a result of COVID-19. Additionally, we incurred $0.4 million in transaction costs related to the Wisely Acquisition that closed on November 4, 2021. As a percentage of total revenue, sales and marketing expense increased to 12.0% for the year ended December 31, 2021 from 8.7% for the year ended December 31, 2020 . Other Expenses Year Ended December 31, Change 2021 2020 $ % (in thousands, except percentages) Other expenses, net: Interest expense $ — $ (157) $ 157 (100.0) % Percentage of total revenue — % (0.2) % Other income, net 77 28 49 175.0 % Percentage of total revenue 0.1 % — % Change in fair value of warrant liability (18,930) (12,714) (6,216) 48.9 % Percentage of total revenue (12.7) % (12.9) % Total other expenses, net $ (18,853) $ (12,843) $ (6,010) 46.8 % Percentage of total revenue (12.6) % (13.0) % Interest expense We had no borrowings outstanding under our credit facility during the year ended December 31, 2021 . For the year ended December 31, 2020 , we had outstanding borrowings during the first quarter of 2020 , resulting in interest expense of $0.2 million . Change in Fair Value of Warrant Liability The increase of $6.2 million in the fair value of warrant liability for the year ended December 31, 2021 was the result of an increase in value of our redeemable convertible preferred stock warrant liability, which is directly related to an increase in the value of our stock underlying the warrants during the first quarter of 2021. Prior to our IPO, all outstanding warrants were exercised to purchase shares of our outstanding redeemable convertible preferred stock and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our outstanding redeemable convertible preferred stock, inclusive of the shares issued pursuant to these warrant exercises, converted into shares of Class B common stock. 60

2022 10K Page 66 Page 68

2022 10K Page 66 Page 68