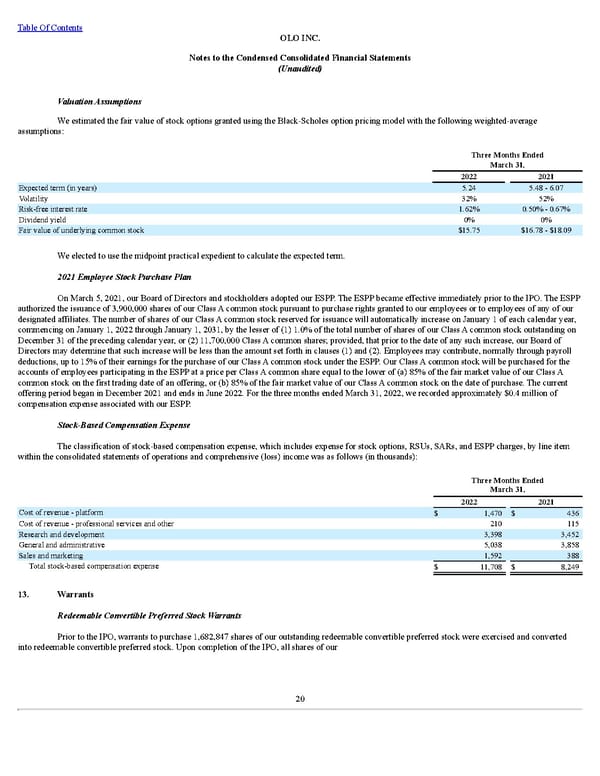

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) Valuation Assumptions We estimated the fair value of stock options granted using the Black-Scholes option pricing model with the following weighted-average assumptions: Three Months Ended March 31, 2022 2021 Expected term (in years) 5.24 5.48 - 6.07 Volatility 32% 52% Risk-free interest rate 1.62% 0.50% - 0.67% Dividend yield 0% 0% Fair value of underlying common stock $15.75 $16.78 - $18.09 We elected to use the midpoint practical expedient to calculate the expected term. 2021 Employee Stock Purchase Plan On March 5, 2021, our Board of Directors and stockholders adopted our ESPP. The ESPP became effective immediately prior to the IPO. The ESPP authorized the issuance of 3,900,000 shares of our Class A common stock pursuant to purchase rights granted to our employees or to employees of any of our designated affiliates. The number of shares of our Class A common stock reserved for issuance will automatically increase on January 1 of each calendar year, commencing on January 1, 2022 through January 1, 2031, by the lesser of (1) 1.0% of the total number of shares of our Class A common stock outstanding on December 31 of the preceding calendar year, or (2) 11,700,000 Class A common shares; provided, that prior to the date of any such increase, our Board of Directors may determine that such increase will be less than the amount set forth in clauses (1) and (2). Employees may contribute, normally through payroll deductions, up to 15% of their earnings for the purchase of our Class A common stock under the ESPP. Our Class A common stock will be purchased for the accounts of employees participating in the ESPP at a price per Class A common share equal to the lower of (a) 85% of the fair market value of our Class A common stock on the first trading date of an offering, or (b) 85% of the fair market value of our Class A common stock on the date of purchase. The current offering period began in December 2021 and ends in June 2022. For the three months ended March 31, 2022, we recorded approximately $0.4 million of compensation expense associated with our ESPP. Stock-Based Compensation Expense The classification of stock-based compensation expense, which includes expense for stock options, RSUs, SARs, and ESPP charges, by line item within the consolidated statements of operations and comprehensive (loss) income was as follows (in thousands): Three Months Ended March 31, 2022 2021 Cost of revenue - platform $ 1,470 $ 436 Cost of revenue - professional services and other 210 115 Research and development 3,398 3,452 General and administrative 5,038 3,858 Sales and marketing 1,592 388 Total stock-based compensation expense $ 11,708 $ 8,249 13. Warrants Redeemable Convertible Preferred Stock Warrants Prior to the IPO, warrants to purchase 1,682,847 shares of our outstanding redeemable convertible preferred stock were exercised and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our 20

Q1 2022 10Q Page 23 Page 25

Q1 2022 10Q Page 23 Page 25