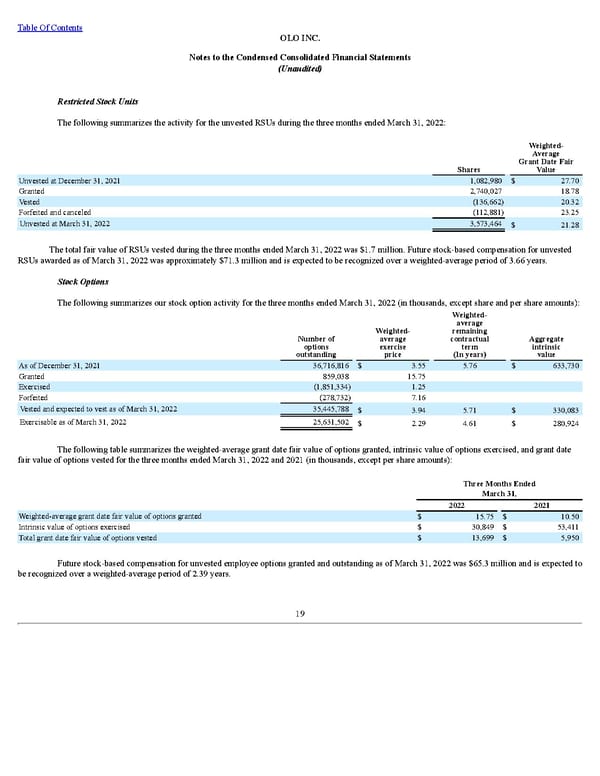

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) Restricted Stock Units The following summarizes the activity for the unvested RSUs during the three months ended March 31, 2022: Shares Weighted- Average Grant Date Fair Value Unvested at December 31, 2021 1,082,980 $ 27.70 Granted 2,740,027 18.78 Vested (136,662) 20.32 Forfeited and canceled (112,881) 23.25 Unvested at March 31, 2022 3,573,464 $ 21.28 The total fair value of RSUs vested during the three months ended March 31, 2022 was $1.7 million. Future stock-based compensation for unvested RSUs awarded as of March 31, 2022 was approximately $71.3 million and is expected to be recognized over a weighted-average period of 3.66 years. Stock Options The following summarizes our stock option activity for the three months ended March 31, 2022 (in thousands, except share and per share amounts): Number of options outstanding Weighted- average exercise price Weighted- average remaining contractual term (In years) Aggregate intrinsic value As of December 31, 2021 36,716,816 $ 3.55 5.76 $ 633,730 Granted 859,038 15.75 Exercised (1,851,334) 1.25 Forfeited (278,732) 7.16 Vested and expected to vest as of March 31, 2022 35,445,788 $ 3.94 5.71 $ 330,083 Exercisable as of March 31, 2022 25,631,502 $ 2.29 4.61 $ 280,924 The following table summarizes the weighted-average grant date fair value of options granted, intrinsic value of options exercised, and grant date fair value of options vested for the three months ended March 31, 2022 and 2021 (in thousands, except per share amounts): Three Months Ended March 31, 2022 2021 Weighted-average grant date fair value of options granted $ 15.75 $ 10.50 Intrinsic value of options exercised $ 30,849 $ 53,411 Total grant date fair value of options vested $ 13,699 $ 5,950 Future stock-based compensation for unvested employee options granted and outstanding as of March 31, 2022 was $65.3 million and is expected to be recognized over a weighted-average period of 2.39 years. 19

Q1 2022 10Q Page 22 Page 24

Q1 2022 10Q Page 22 Page 24