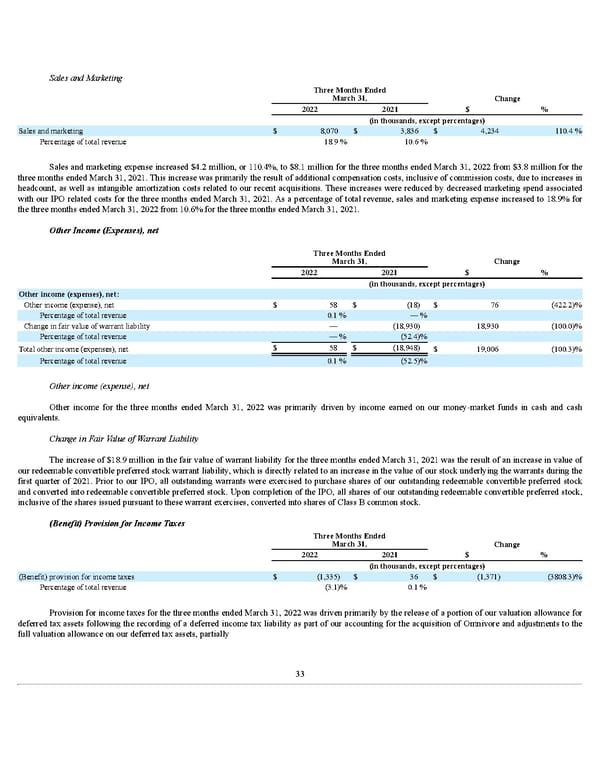

Sales and Marketing Three Months Ended March 31, Change 2022 2021 $ % (in thousands, except per centages) Sales and marketing $ 8,070 $ 3,836 $ 4,234 110.4 % Percentage of total revenue 18.9 % 10.6 % Sales and marketing expense increased $4.2 million, or 110.4%, to $8.1 million for the three months ended March 31, 2022 from $3.8 million for the three months ended March 31, 2021. This increase was primarily the result of additional compensation costs, inclusive of commission costs, due to increases in headcount, as well as intangible amortization costs related to our recent acquisitions. These increases were reduced by decreased marketing spend associated with our IPO related costs for the three months ended March 31, 2021. As a percentage of total revenue, sales and marketing expense increased to 18.9% for the three months ended March 31, 2022 from 10.6% for the three months ended March 31, 2021. Other Income (Expenses), net Three Months Ended March 31, Change 2022 2021 $ % (in thousands, except per centages) Other income (expenses), net: Other income (expense), net $ 58 $ (18) $ 76 (422.2) % Percentage of total revenue 0.1 % — % Change in fair value of warrant liability — (18,930) 18,930 (100.0) % Percentage of total revenue — % (52.4) % Total other income (expenses), net $ 58 $ (18,948) $ 19,006 (100.3) % Percentage of total revenue 0.1 % (52.5) % Other income (expense), net Other income for the three months ended March 31, 2022 was primarily driven by income earned on our money-market funds in cash and cash equivalents. Change in Fair Value of Warrant Liability The increase of $18.9 million in the fair value of warrant liability for the three months ended March 31, 2021 was the result of an increase in value of our redeemable convertible preferred stock warrant liability, which is directly related to an increase in the value of our stock underlying the warrants during the first quarter of 2021. Prior to our IPO, all outstanding warrants were exercised to purchase shares of our outstanding redeemable convertible preferred stock and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our outstanding redeemable convertible preferred stock, inclusive of the shares issued pursuant to these warrant exercises, converted into shares of Class B common stock. (Benefit) Provision for Income Taxes Three Months Ended March 31, Change 2022 2021 $ % (in thousands, except per centages) (Benefit) provision for income taxes $ (1,335) $ 36 $ (1,371) (3808.3) % Percentage of total revenue (3.1) % 0.1 % Provision for income taxes for the three months ended March 31, 2022 was driven primarily by the release of a portion of our valuation allowance for deferred tax assets following the recording of a deferred income tax liability as part of our accounting for the acquisition of Omnivore and adjustments to the full valuation allowance on our deferred tax assets, partially 33

Q1 2022 10Q Page 36 Page 38

Q1 2022 10Q Page 36 Page 38