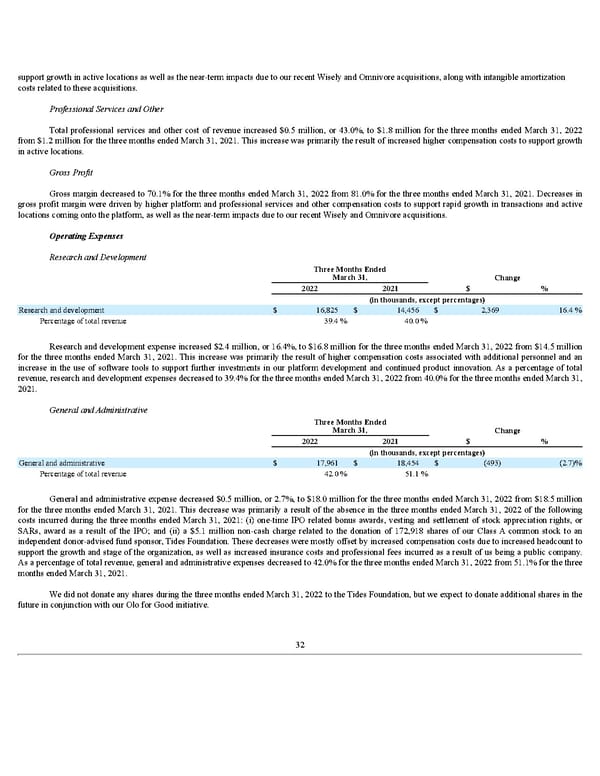

support growth in active locations as well as the near-term impacts due to our recent Wisely and Omnivore acquisitions, along with intangible amortization costs related to these acquisitions. Professional Services and Other Total professional services and other cost of revenue increased $0.5 million, or 43.0%, to $1.8 million for the three months ended March 31, 2022 from $1.2 million for the three months ended March 31, 2021. This increase was primarily the result of increased higher compensation costs to support growth in active locations. Gross Profit Gross margin decreased to 70.1% for the three months ended March 31, 2022 from 81.0% for the three months ended March 31, 2021. Decreases in gross profit margin were driven by higher platform and professional services and other compensation costs to support rapid growth in transactions and active locations coming onto the platform, as well as the near-term impacts due to our recent Wisely and Omnivore acquisitions. Operating Expenses Research and Development Three Months Ended March 31, Change 2022 2021 $ % (in thousands, except per centages) Research and development $ 16,825 $ 14,456 $ 2,369 16.4 % Percentage of total revenue 39.4 % 40.0 % Research and development expense increased $2.4 million, or 16.4%, to $16.8 million for the three months ended March 31, 2022 from $14.5 million for the three months ended March 31, 2021. This increase was primarily the result of higher compensation costs associated with additional personnel and an increase in the use of software tools to support further investments in our platform development and continued product innovation. As a percentage of total revenue, research and development expenses decreased to 39.4% for the three months ended March 31, 2022 from 40.0% for the three months ended March 31, 2021. General and Administrative Three Months Ended March 31, Change 2022 2021 $ % (in thousands, except per centages) General and administrative $ 17,961 $ 18,454 $ (493) (2.7) % Percentage of total revenue 42.0 % 51.1 % General and administrative expense decreased $0.5 million, or 2.7%, to $18.0 million for the three months ended March 31, 2022 from $18.5 million for the three months ended March 31, 2021. This decrease was primarily a result of the absence in the three months ended March 31, 2022 of the following costs incurred during the three months ended March 31, 2021: (i) one-time IPO related bonus awards, vesting and settlement of stock appreciation rights, or SARs, award as a result of the IPO; and (ii) a $5.1 million non-cash charge related to the donation of 172,918 shares of our Class A common stock to an independent donor-advised fund sponsor, Tides Foundation. These decreases were mostly offset by increased compensation costs due to increased headcount to support the growth and stage of the organization, as well as increased insurance costs and professional fees incurred as a result of us being a public company. As a percentage of total revenue, general and administrative expenses decreased to 42.0% for the three months ended March 31, 2022 from 51.1% for the three months ended March 31, 2021. We did not donate any shares during the three months ended March 31, 2022 to the Tides Foundation, but we expect to donate additional shares in the future in conjunction with our Olo for Good initiative. 32

Q1 2022 10Q Page 35 Page 37

Q1 2022 10Q Page 35 Page 37