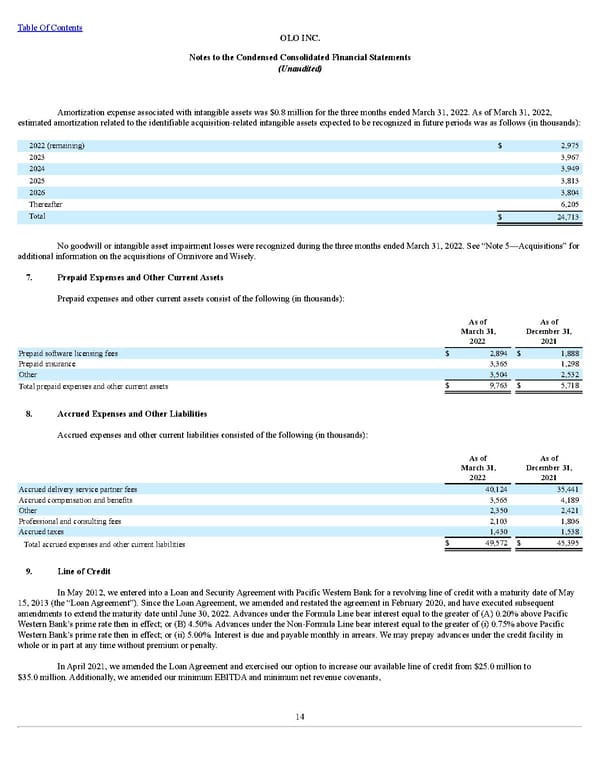

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) Amortization expense associated with intangible assets was $0.8 million for the three months ended March 31, 2022. As of March 31, 2022, estimated amortization related to the identifiable acquisition-related intangible assets expected to be recognized in future periods was as follows (in thousands): 2022 (remaining) $ 2,975 2023 3,967 2024 3,949 2025 3,813 2026 3,804 Thereafter 6,205 Total $ 24,713 No goodwill or intangible asset impairment losses were recognized during the three months ended March 31, 2022. See “Note 5—Acquisitions” for additional information on the acquisitions of Omnivore and Wisely. 7. Prepaid Expenses and Other Current Assets Prepaid expenses and other current assets consist of the following (in thousands): As of Mar ch 31, 2022 As of December 31, 2021 Prepaid software licensing fees $ 2,894 $ 1,888 Prepaid insurance 3,365 1,298 Other 3,504 2,532 Total prepaid expenses and other current assets $ 9,763 $ 5,718 8. Accrued Expenses and Other Liabilities Accrued expenses and other current liabilities c onsisted of the following (in thousands): As of Mar ch 31, 2022 As of December 31, 2021 Accrued delivery service partner fees 40,124 35,441 Accrued compensation and benefits 3,565 4,189 Other 2,350 2,421 Professional and consulting fees 2,103 1,806 Accrued taxes 1,430 1,538 Total accrued expenses and other current liabilities $ 49,572 $ 45,395 9. Line of Credit In May 2012, we entered into a Loan and Security Agreement with Pacific Western Bank for a revolving line of credit with a maturity date of May 15, 2013 (the “Loan Agreement”). Since the Loan Agreement, we amended and restated the agreement in February 2020, and have executed subsequent amendments to extend the maturity date until June 30, 2022. Advances under the Formula Line bear interest equal to the greater of (A) 0.20% above Pacific Western Bank’s prime rate then in effect; or (B) 4.50%. Advances under the Non-Formula Line bear interest equal to the greater of (i) 0.75% above Pacific Western Bank’s prime rate then in effect; or (ii) 5.00%. Interest is due and payable monthly in arrears. We may prepay advances under the credit facility in whole or in part at any time without premium or penalty. In April 2021, we amended the Loan Agreement and exercised our option to increase our available line of credit from $25.0 million to $35.0 million. Additionally, we amended our minimum EBITDA and minimum net revenue covenants, 14

Q1 2022 10Q Page 17 Page 19

Q1 2022 10Q Page 17 Page 19