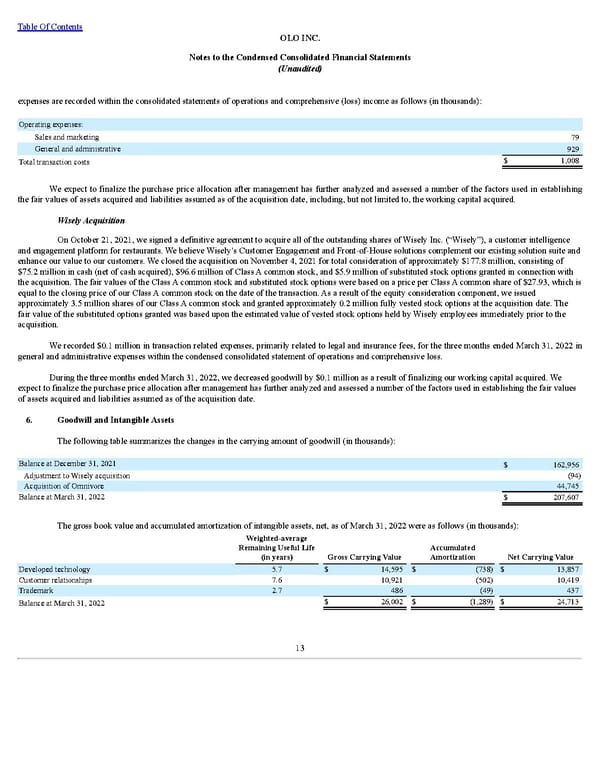

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) expenses are recorded within the consolidated statements of operations and comprehensive (loss) income as follows (in thousands): Operating expenses: Sales and marketing 79 General and administrative 929 Total transaction costs $ 1,008 We expect to finalize the purchase price allocation after management has further analyzed and assessed a number of the factors used in establishing the fair values of assets acquired and liabilities assumed as of the acquisition date, including, but not limited to, the working capital acquired. Wisely Acquisition On October 21, 2021, we signed a definitive agreement to acquire all of the outstanding shares of Wisely Inc. (“Wisely”), a customer intelligence and engagement platform for restaurants. We believe Wisely’s Customer Engagement and Front-of-House solutions complement our existing solution suite and enhance our value to our customers. We closed the acquisition on November 4, 2021 for total consideration of approximately $177.8 million, consisting of $75.2 million in cash (net of cash acquired), $96.6 million of Class A common stock, and $5.9 million of substituted stock options granted in connection with the acquisition. The fair values of the Class A common stock and substituted stock options were based on a price per Class A common share of $27.93, which is equal to the closing price of our Class A common stock on the date of the transaction. As a result of the equity consideration component, we issued approximately 3.5 million shares of our Class A common stock and granted approximately 0.2 million fully vested stock options at the acquisition date. The fair value of the substituted options granted was based upon the estimated value of vested stock options held by Wisely employees immediately prior to the acquisition. We recorded $0.1 million in transaction related expenses, primarily related to legal and insurance fees, for the three months ended March 31, 2022 in general and administrative expenses within the condensed consolidated statement of operations and comprehensive loss. During the three months ended March 31, 2022, we decreased goodwill by $0.1 million as a result of finalizing our working capital acquired. We expect to finalize the purchase price allocation after management has further analyzed and assessed a number of the factors used in establishing the fair values of assets acquired and liabilities assumed as of the acquisition date. 6. Goodwill and Intangible Assets The following table summarizes the changes in the carrying amount of goodwill (in thousands): Balance at December 31, 2021 $ 162,956 Adjustment to Wisely acquisition (94) Acquisition of Omnivore 44,745 Balance at March 31, 2022 $ 207,607 The gross book value and accumulated amortization of intangible assets, net, as of March 31, 2022 were as follows (in thousands): Weighted-average Remaining Useful Life (in years) Gross Carrying Value Accumulated Amortization Net Carrying Value Developed technology 5.7 $ 14,595 $ (738) $ 13,857 Customer relationships 7.6 10,921 (502) 10,419 Trademark 2.7 486 (49) 437 Balance at March 31, 2022 $ 26,002 $ (1,289) $ 24,713 13

Q1 2022 10Q Page 16 Page 18

Q1 2022 10Q Page 16 Page 18