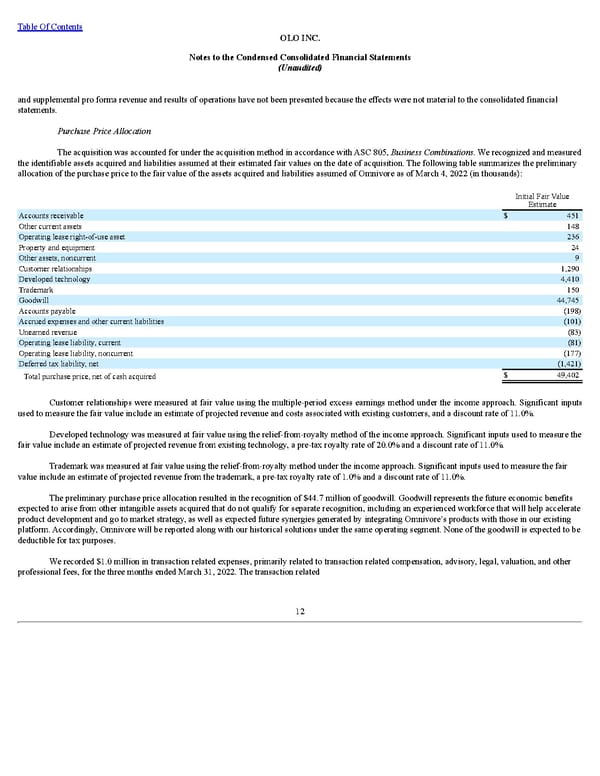

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) and supplemental pro forma revenue and results of operations have not been presented because the effects were not material to the consolidated financial statements. Purchase Price Allocation The acquisition was accounted for under the acquisition method in accordance with ASC 805, Business Combinations . We recognized and measured the identifiable assets acquired and liabilities assumed at their estimated fair values on the date of acquisition. The following table summarizes the preliminary allocation of the purchase price to the fair value of the assets acquired and liabilities assumed of Omnivore as of March 4, 2022 (in thousands): Initial Fair Value Estimate Accounts receivable $ 451 Other current assets 148 Operating lease right-of-use asset 236 Property and equipment 24 Other assets, noncurrent 9 Customer relationships 1,290 Developed technology 4,410 Trademark 150 Goodwill 44,745 Accounts payable (198) Accrued expenses and other current liabilities (101) Unearned revenue (83) Operating lease liability , current (81) Operating lease liability , noncurrent (177) Deferred tax liability , net (1,421) Total purchase price, net of cash acquired $ 49,402 Customer relationships were measured at fair value using the multiple-period excess earnings method under the income approach. Significant inputs used to measure the fair value include an estimate of projected revenue and costs associated with existing customers, and a discount rate of 11.0%. Developed technology was measured at fair value using the relief-from-royalty method of the income approach. Significant inputs used to measure the fair value include an estimate of projected revenue from existing technology, a pre-tax royalty rate of 20.0% and a discount rate of 11.0%. Trademark was measured at fair value using the relief-from-royalty method under the income approach. Significant inputs used to measure the fair value include an estimate of projected revenue from the trademark, a pre-tax royalty rate of 1.0% and a discount rate of 11.0%. The preliminary purchase price allocation resulted in the recognition of $44.7 million of goodwill. Goodwill represents the future economic benefits expected to arise from other intangible assets acquired that do not qualify for separate recognition, including an experienced workforce that will help accelerate product development and go to market strategy, as well as expected future synergies generated by integrating Omnivore’s products with those in our existing platform. Accordingly, Omnivore will be reported along with our historical solutions under the same operating segment. None of the goodwill is expected to be deductible for tax purposes. We recorded $1.0 million in transaction related expenses, primarily related to transaction related compensation, advisory, legal, valuation, and other professional fees, for the three months ended March 31, 2022. The transaction related 12

Q1 2022 10Q Page 15 Page 17

Q1 2022 10Q Page 15 Page 17