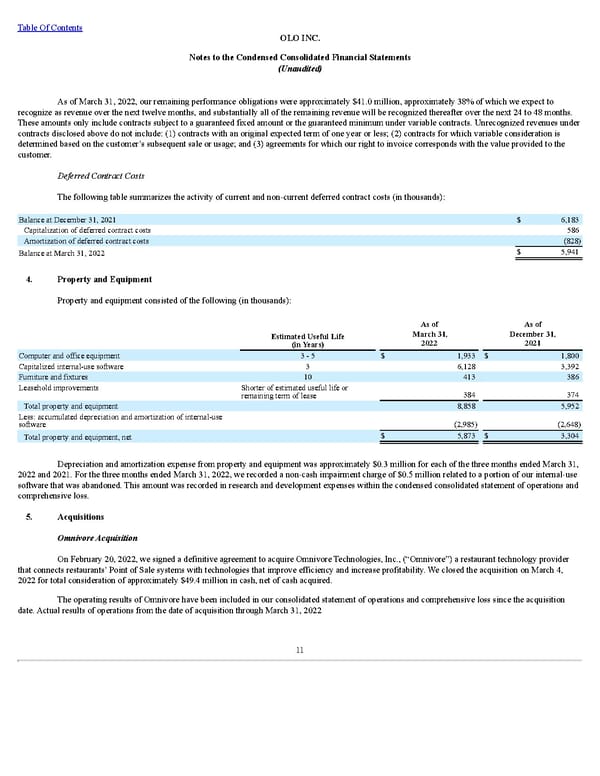

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) As of March 31, 2022, our remaining performance obligations were approximately $41.0 million, approximately 38% of which we expect to recognize as revenue over the next twelve months, and substantially all of the remaining revenue will be recognized thereafter over the next 24 to 48 months. These amounts only include contracts subject to a guaranteed fixed amount or the guaranteed minimum under variable contracts. Unrecognized revenues under contracts disclosed above do not include: (1) contracts with an original expected term of one year or less; (2) contracts for which variable consideration is determined based on the customer’s subsequent sale or usage; and (3) agreements for which our right to invoice corresponds with the value provided to the customer. Deferred Contract Costs The following table summarizes the activity of current and non-current deferred contract costs (in thousands): Balance at December 31, 2021 $ 6,183 Capitalization of deferred contract costs 586 Amortization of deferred contract costs (828) Balance at March 31, 2022 $ 5,941 4. Property and Equipment Property and equipment consisted of the following (in thousands): Estimated Useful Life (in Years) As of Mar ch 31, 2022 As of December 31, 2021 Computer and of fice equipment 3 - 5 $ 1,933 $ 1,800 Capitalized internal-use software 3 6,128 3,392 Furniture and fixtures 10 413 386 Leasehold improvements Shorter of estimated useful life or remaining term of lease 384 374 Total property and equipment 8,858 5,952 Less: accumulated depreciation and amortization of internal-use software (2,985) (2,648) Total property and equipment, net $ 5,873 $ 3,304 Depreciation and amortization expense from property and equipment was approximately $0.3 million for each of the three months ended March 31, 2022 and 2021. For the three months ended March 31, 2022, we recorded a non-cash impairment charge of $0.5 million related to a portion of our internal-use software that was abandoned. This amount was recorded in research and development expenses within the condensed consolidated statement of operations and comprehensive loss. 5. Acquisitions Omnivore Acquisition On February 20, 2022, we signed a definitive agreement to acquire Omnivore Technologies, Inc., (“Omnivore”) a restaurant technology provider that connects restaurants’ Point of Sale systems with technologies that improve efficiency and increase profitability. We closed the acquisition on March 4, 2022 for total consideration of approximately $49.4 million in cash, net of cash acquired. The operating results of Omnivore have been included in our consolidated statement of operations and comprehensive loss since the acquisition date. Actual results of operations from the date of acquisition through March 31, 2022 11

Q1 2022 10Q Page 14 Page 16

Q1 2022 10Q Page 14 Page 16