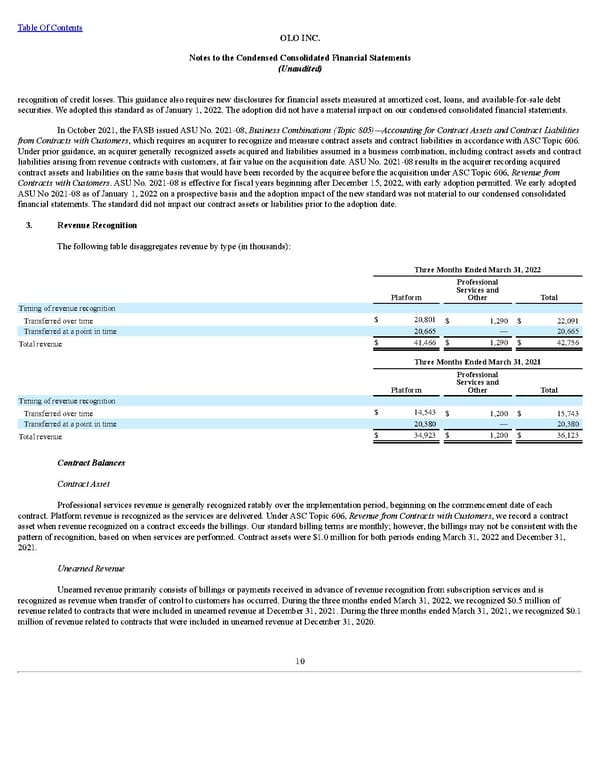

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) recognition of credit losses. This guidance also requires new disclosures for financial assets measured at amortized cost, loans, and available-for-sale debt securities. We adopted this standard as of January 1, 2022. The adoption did not have a material impact on our condensed consolidated financial statements. In October 2021, the FASB issued ASU No. 2021-08, Business Combinations (Topic 805)—Accounting for Contract Assets and Contract Liabilities from Contracts with Customers , which requires an acquirer to recognize and measure contract assets and contract liabilities in accordance with ASC Topic 606. Under prior guidance, an acquirer generally recognized assets acquired and liabilities assumed in a business combination, including contract assets and contract liabilities arising from revenue contracts with customers, at fair value on the acquisition date. ASU No. 2021-08 results in the acquirer recording acquired contract assets and liabilities on the same basis that would have been recorded by the acquiree before the acquisition under ASC Topic 606, Revenue from Contracts with Customers . ASU No. 2021-08 is effective for fiscal years beginning after December 15, 2022, with early adoption permitted. We early adopted ASU No 2021-08 as of January 1, 2022 on a prospective basis and the adoption impact of the new standard was not material to our condensed consolidated financial statements. The standard did not impact our contract assets or liabilities prior to the adoption date. 3. Revenue Recognition The following table disaggregates revenue by type (in thousands): Three Months Ended Mar ch 31, 2022 Platform Professional Services and Other Total Timing of revenue recognition Transferred over time $ 20,801 $ 1,290 $ 22,091 Transferred at a point in time 20,665 — 20,665 Total revenue $ 41,466 $ 1,290 $ 42,756 Three Months Ended Mar ch 31, 2021 Platform Professional Services and Other Total Timing of revenue recognition Transferred over time $ 14,543 $ 1,200 $ 15,743 Transferred at a point in time 20,380 — 20,380 Total revenue $ 34,923 $ 1,200 $ 36,123 Contract Balances Contract Asset Professional services revenue is generally recognized ratably over the implementation period, beginning on the commencement date of each contract. Platform revenue is recognized as the services are delivered. Under ASC Topic 606, Revenue from Contracts with Customers , we record a contract asset when revenue recognized on a contract exceeds the billings. Our standard billing terms are monthly; however, the billings may not be consistent with the pattern of recognition, based on when services are performed. Contract assets were $1.0 million for both periods ending March 31, 2022 and December 31, 2021. Unearned Revenue Unearned revenue primarily consists of billings or payments received in advance of revenue recognition from subscription services and is recognized as revenue when transfer of control to customers has occurred. During the three months ended March 31, 2022, we recognized $0.5 million of revenue related to contracts that were included in unearned revenue at December 31, 2021. During the three months ended March 31, 2021, we recognized $0.1 million of revenue related to contracts that were included in unearned revenue at December 31, 2020. 10

Q1 2022 10Q Page 13 Page 15

Q1 2022 10Q Page 13 Page 15