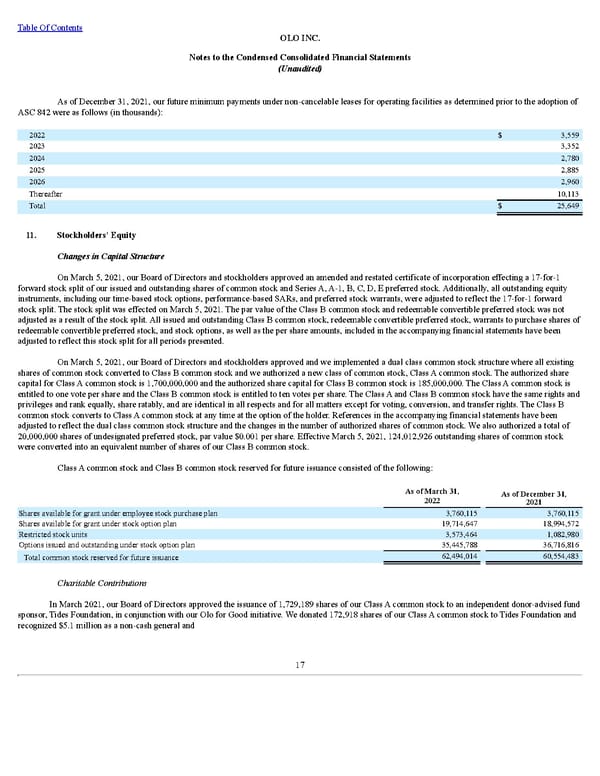

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) As of December 31, 2021, our future minimum payments under non-cancelable leases for operating facilities as determined prior to the adoption of ASC 842 were as follows (in thousands): 2022 $ 3,559 2023 3,352 2024 2,780 2025 2,885 2026 2,960 Thereafter 10,113 Total $ 25,649 11. Stockholders’ Equity Changes in Capital Structure On March 5, 2021, our Board of Directors and stockholders approved an amended and restated certificate of incorporation effecting a 17-for-1 forward stock split of our issued and outstanding shares of common stock and Series A, A-1, B, C, D, E preferred stock. Additionally, all outstanding equity instruments, including our time-based stock options, performance-based SARs, and preferred stock warrants, were adjusted to reflect the 17-for-1 forward stock split. The stock split was effected on March 5, 2021. The par value of the Class B common stock and redeemable convertible preferred stock was not adjusted as a result of the stock split. All issued and outstanding Class B common stock, redeemable convertible preferred stock, warrants to purchase shares of redeemable convertible preferred stock, and stock options, as well as the per share amounts, included in the accompanying financial statements have been adjusted to reflect this stock split for all periods presented. On March 5, 2021, our Board of Directors and stockholders approved and we implemented a dual class common stock structure where all existing shares of common stock converted to Class B common stock and we authorized a new class of common stock, Class A common stock. The authorized share capital for Class A common stock is 1,700,000,000 and the authorized share capital for Class B common stock is 185,000,000. The Class A common stock is entitled to one vote per share and the Class B common stock is entitled to ten votes per share. The Class A and Class B common stock have the same rights and privileges and rank equally, share ratably, and are identical in all respects and for all matters except for voting, conversion, and transfer rights. The Class B common stock converts to Class A common stock at any time at the option of the holder. References in the accompanying financial statements have been adjusted to reflect the dual class common stock structure and the changes in the number of authorized shares of common stock. We also authorized a total of 20,000,000 shares of undesignated preferred stock, par value $0.001 per share. Effective March 5, 2021, 124,012,926 outstanding shares of common stock were converted into an equivalent number of shares of our Class B common stock. Class A common stock and Class B common stock reserved for future issuance consisted of the following: As of Mar ch 31, 2022 As of December 31, 2021 Shares available for grant under employee stock purchase plan 3,760,1 15 3,760,1 15 Shares available for grant under stock option plan 19,714,647 18,994,572 Restricted stock units 3,573,464 1,082,980 Options issued and outstanding under stock option plan 35,445,788 36,716,816 Total common stock reserved for future issuance 62,494,014 60,554,483 Charitable Contributions In March 2021, our Board of Directors approved the issuance of 1,729,189 shares of our Class A common stock to an independent donor-advised fund sponsor, Tides Foundation, in conjunction with our Olo for Good initiative. We donated 172,918 shares of our Class A common stock to Tides Foundation and recognized $5.1 million as a non-cash general and 17

Q1 2022 10Q Page 20 Page 22

Q1 2022 10Q Page 20 Page 22