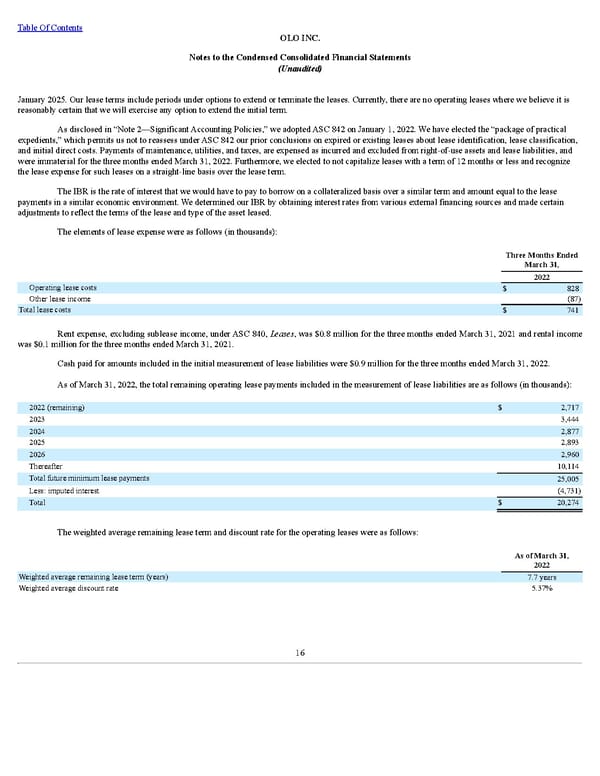

Table Of Contents OLO INC. Notes to the Condensed Consolidated Financial Statements (Unaudited) January 2025. Our lease terms include periods under options to extend or terminate the leases. Currently, there are no operating leases where we believe it is reasonably certain that we will exercise any option to extend the initial term. As disclosed in “Note 2—Significant Accounting Policies,” we adopted ASC 842 on January 1, 2022. We have elected the “package of practical expedients,” which permits us not to reassess under ASC 842 our prior conclusions on expired or existing leases about lease identification, lease classification, and initial direct costs. Payments of maintenance, utilities, and taxes, are expensed as incurred and excluded from right-of-use assets and lease liabilities, and were immaterial for the three months ended March 31, 2022. Furthermore, we elected to not capitalize leases with a term of 12 months or less and recognize the lease expense for such leases on a straight-line basis over the lease term. The IBR is the rate of interest that we would have to pay to borrow on a collateralized basis over a similar term and amount equal to the lease payments in a similar economic environment. We determined our IBR by obtaining interest rates from various external financing sources and made certain adjustments to reflect the terms of the lease and type of the asset leased. The elements of lease expense were as follows (in thousands): Three Months Ended March 31, 2022 Operating lease costs $ 828 Other lease income (87) Total lease costs $ 741 Rent expense, excluding sublease income, under ASC 840, Leases , was $0.8 million for the three months ended March 31, 2021 and rental income was $0.1 million for the three months ended March 31, 2021. Cash paid for amounts included in the initial measurement of lease liabilities were $0.9 million for the three months ended March 31, 2022. As of March 31, 2022, the total remaining operating lease payments included in the measurement of lease liabilities are as follows (in thousands): 2022 (remaining) $ 2,717 2023 3,444 2024 2,877 2025 2,893 2026 2,960 Thereafter 10,114 Total future minimum lease payments 25,005 Less: imputed interest (4,731) Total $ 20,274 The weighted average remaining lease term and discount rate for the operating leases were as follows: As of Mar ch 31, 2022 Weighted average remaining lease term (years) 7.7 years Weighted average discount rate 5.37% 16

Q1 2022 10Q Page 19 Page 21

Q1 2022 10Q Page 19 Page 21