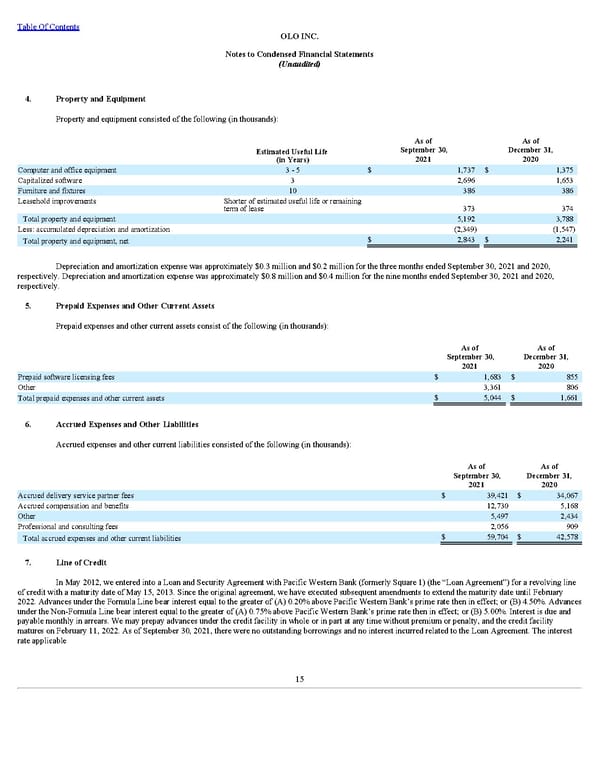

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) 4. Property and Equipment Property and equipment consisted of the following (in thousands): Estimated Useful Life (in Years) As of September 30, 2021 As of December 31, 2020 Computer and office equipment 3 - 5 $ 1,737 $ 1,375 Capitalized software 3 2,696 1,653 Furniture and fixtures 10 386 386 Leasehold improvements Shorter of estimated useful life or remaining term of lease 373 374 Total property and equipment 5,192 3,788 Less: accumulated depreciation and amortization (2,349) (1,547) Total property and equipment, net $ 2,843 $ 2,241 Depreciation and amortization expense was approximately $0.3 million and $0.2 million for the three months ended September 30, 2021 and 2020, respectively. Depreciation and amortization expense was approximately $0.8 million and $0.4 million for the nine months ended September 30, 2021 and 2020, respectively. 5. Prepaid Expenses and Other Current Assets Prepaid expenses and other current assets consist of the following (in thousands): As of September 30, 2021 As of December 31, 2020 Prepaid software licensing fees $ 1,683 $ 855 Other 3,361 806 Total prepaid expenses and other current assets $ 5,044 $ 1,661 6. Accrued Expenses and Other Liabilities Accrued expenses and other current liabilities c onsisted of the following (in thousands): As of September 30, 2021 As of December 31, 2020 Accrued delivery service partner fees $ 39,421 $ 34,067 Accrued compensation and benefits 12,730 5,168 Other 5,497 2,434 Professional and consulting fees 2,056 909 Total accrued expenses and other current liabilities $ 59,704 $ 42,578 7. Line of Credit In May 2012, we entered into a Loan and Security Agreement with Pacific Western Bank (formerly Square 1) (the “Loan Agreement”) for a revolving line of credit with a maturity date of May 15, 2013. Since the original agreement, we have executed subsequent amendments to extend the maturity date until February 2022. Advances under the Formula Line bear interest equal to the greater of (A) 0.20% above Pacific Western Bank’s prime rate then in effect; or (B) 4.50%. Advances under the Non-Formula Line bear interest equal to the greater of (A) 0.75% above Pacific Western Bank’s prime rate then in effect; or (B) 5.00%. Interest is due and payable monthly in arrears. We may prepay advances under the credit facility in whole or in part at any time without premium or penalty, and the credit facility matures on February 11, 2022. As of September 30, 2021, there were no outstanding borrowings and no interest incurred related to the Loan Agreement. The interest rate applicable 15

Q3 2021 10Q Page 20 Page 22

Q3 2021 10Q Page 20 Page 22