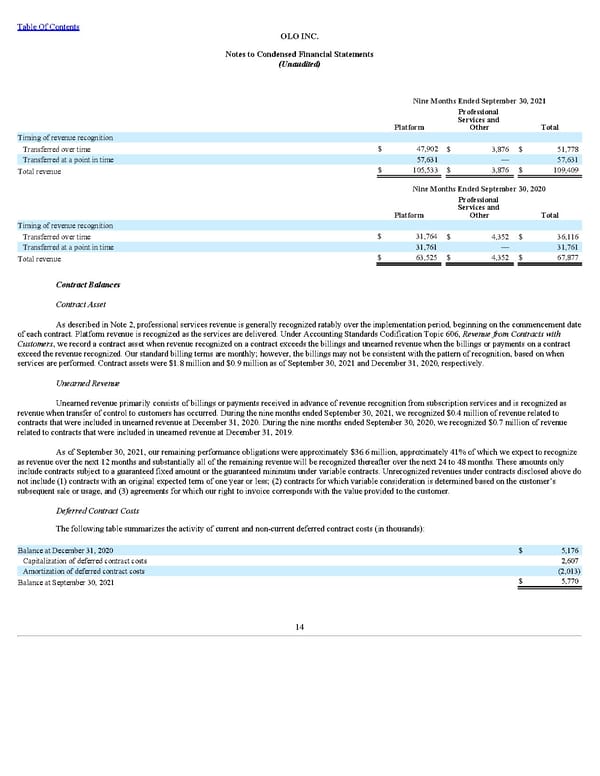

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) Nine Months Ended September 30, 2021 Platform Professional Services and Other Total Timing of revenue recognition Transferred over time $ 47,902 $ 3,876 $ 51,778 Transferred at a point in time 57,631 — 57,631 Total revenue $ 105,533 $ 3,876 $ 109,409 Nine Months Ended September 30, 2020 Platform Professional Services and Other Total Timing of revenue recognition Transferred over time $ 31,764 $ 4,352 $ 36,116 Transferred at a point in time 31,761 — 31,761 Total revenue $ 63,525 $ 4,352 $ 67,877 Contract Balances Contract Asset As described in Note 2, professional services revenue is generally recognized ratably over the implementation period, beginning on the commencement date of each contract. Platform revenue is recognized as the services are delivered. Under Accounting Standards Codification Topic 606, Revenue from Contracts with Customers , we record a contract asset when revenue recognized on a contract exceeds the billings and unearned revenue when the billings or payments on a contract exceed the revenue recognized. Our standard billing terms are monthly; however, the billings may not be consistent with the pattern of recognition, based on when services are performed. Contract assets were $1.8 million and $0.9 million as of September 30, 2021 and December 31, 2020, respectively. Unearned Revenue Unearned revenue primarily consists of billings or payments received in advance of revenue recognition from subscription services and is recognized as revenue when transfer of control to customers has occurred. During the nine months ended September 30, 2021, we recognized $0.4 million of revenue related to contracts that were included in unearned revenue at December 31, 2020. During the nine months ended September 30, 2020, we recognized $0.7 million of revenue related to contracts that were included in unearned revenue at December 31, 2019. As of September 30, 2021, our remaining performance obligations were approximately $36.6 million, approximately 41% of which we expect to recognize as revenue over the next 12 months and substantially all of the remaining revenue will be recognized thereafter over the next 24 to 48 months. These amounts only include contracts subject to a guaranteed fixed amount or the guaranteed minimum under variable contracts. Unrecognized revenues under contracts disclosed above do not include (1) contracts with an original expected term of one year or less; (2) contracts for which variable consideration is determined based on the customer’s subsequent sale or usage, and (3) agreements for which our right to invoice corresponds with the value provided to the customer. Deferred Contract Costs The following table summarizes the activity of current and non-current deferred contract costs (in thousands): Balance at December 31, 2020 $ 5,176 Capitalization of deferred contract costs 2,607 Amortization of deferred contract costs (2,013) Balance at September 30, 2021 $ 5,770 14

Q3 2021 10Q Page 19 Page 21

Q3 2021 10Q Page 19 Page 21