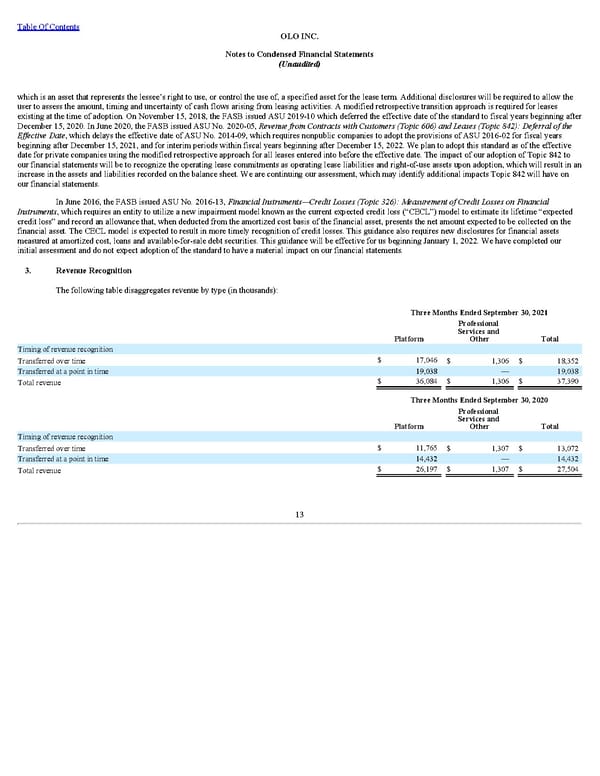

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term. Additional disclosures will be required to allow the user to assess the amount, timing and uncertainty of cash flows arising from leasing activities. A modified retrospective transition approach is required for leases existing at the time of adoption. On November 15, 2018, the FASB issued ASU 2019-10 which deferred the effective date of the standard to fiscal years beginning after December 15, 2020. In June 2020, the FASB issued ASU No. 2020-05, Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842): Deferral of the Effective Date , which delays the effective date of ASU No. 2014-09, which requires nonpublic companies to adopt the provisions of ASU 2016-02 for fiscal years beginning after December 15, 2021, and for interim periods within fiscal years beginning after December 15, 2022. We plan to adopt this standard as of the effective date for private companies using the modified retrospective approach for all leases entered into before the effective date. The impact of our adoption of Topic 842 to our financial statements will be to recognize the operating lease commitments as operating lease liabilities and right-of-use assets upon adoption, which will result in an increase in the assets and liabilities recorded on the balance sheet. We are continuing our assessment, which may identify additional impacts Topic 842 will have on our financial statements. In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments , which requires an entity to utilize a new impairment model known as the current expected credit loss (“CECL”) model to estimate its lifetime “expected credit loss” and record an allowance that, when deducted from the amortized cost basis of the financial asset, presents the net amount expected to be collected on the financial asset. The CECL model is expected to result in more timely recognition of credit losses. This guidance also requires new disclosures for financial assets measured at amortized cost, loans and available-for-sale debt securities. This guidance will be effective for us beginning January 1, 2022. We have completed our initial assessment and do not expect adoption of the standard to have a material impact on our financial statements. 3. Revenue Recognition The following table disaggregates revenue by type (in thousands): Three Months Ended September 30, 2021 Platform Professional Services and Other Total Timing of revenue recognition Transferred over time $ 17,046 $ 1,306 $ 18,352 Transferred at a point in time 19,038 — 19,038 Total revenue $ 36,084 $ 1,306 $ 37,390 Three Months Ended September 30, 2020 Platform Professional Services and Other Total Timing of revenue recognition Transferred over time $ 11,765 $ 1,307 $ 13,072 Transferred at a point in time 14,432 — 14,432 Total revenue $ 26,197 $ 1,307 $ 27,504 13

Q3 2021 10Q Page 18 Page 20

Q3 2021 10Q Page 18 Page 20