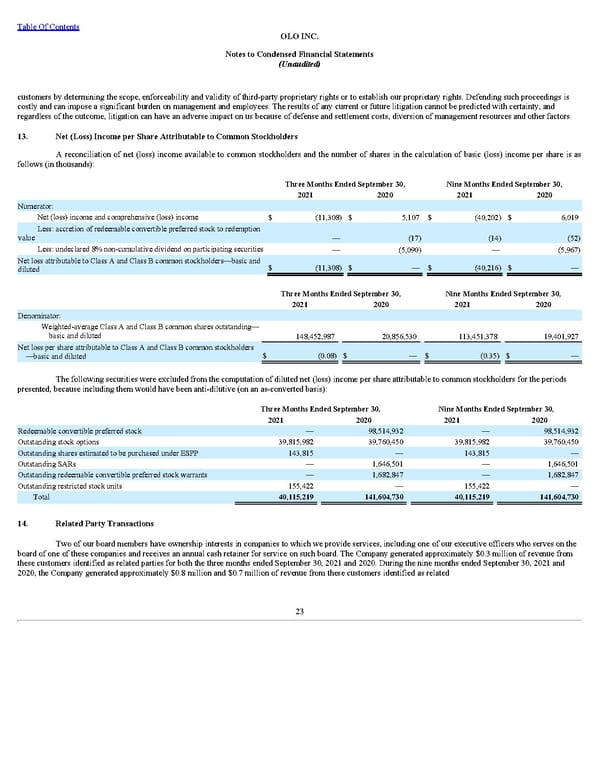

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) customers by determining the scope, enforceability and validity of third-party proprietary rights or to establish our proprietary rights. Defending such proceedings is costly and can impose a significant burden on management and employees. The results of any current or future litigation cannot be predicted with certainty, and regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors. 13. Net (Loss) Income per Share Attributable to Common Stockholders A reconciliation of net (loss) income available to common stockholders and the number of shares in the calculation of basic (loss) income per share is as follows (in thousands): Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Numerator: Net (loss) income and comprehensive (loss) income $ (11,308) $ 5,107 $ (40,202) $ 6,019 Less: accretion of redeemable convertible preferred stock to redemption value — (17) (14) (52) Less: undeclared 8% non-cumulative dividend on participating securities — (5,090) — (5,967) Net loss attributable to Class A and Class B common stockholders—basic and diluted $ (11,308) $ — $ (40,216) $ — Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Denominator: Weighted-average Class A and Class B common shares outstanding— basic and diluted 148,452,987 20,856,530 113,451,378 19,401,927 Net loss per share attributable to Class A and Class B common stockholders —basic and diluted $ (0.08) $ — $ (0.35) $ — The following securities were excluded from the computation of diluted net (loss) income per share attributable to common stockholders for the periods presented, because including them would have been anti-dilutive (on an as-converted basis): Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Redeemable convertible preferred stock — 98,514,932 — 98,514,932 Outstanding stock options 39,815,982 39,760,450 39,815,982 39,760,450 Outstanding shares estimated to be purchased under ESPP 143,815 — 143,815 — Outstanding SARs — 1,646,501 — 1,646,501 Outstanding redeemable convertible preferred stock warrants — 1,682,847 — 1,682,847 Outstanding restricted stock units 155,422 — 155,422 — Total 40,115,219 141,604,730 40,115,219 141,604,730 14. Related Party Transactions Two of our board members have ownership interests in companies to which we provide services, including one of our executive officers who serves on the board of one of these companies and receives an annual cash retainer for service on such board. The Company generated approximately $0.3 million of revenue from these customers identified as related parties for both the three months ended September 30, 2021 and 2020. During the nine months ended September 30, 2021 and 2020, the Company generated approximately $0.8 million and $0.7 million of revenue from these customers identified as related 23

Q3 2021 10Q Page 28 Page 30

Q3 2021 10Q Page 28 Page 30