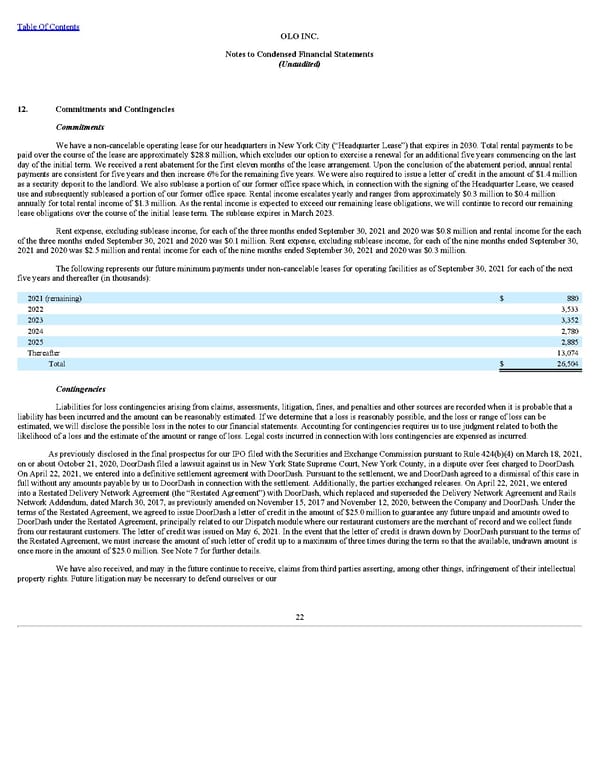

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) 12. Commitments and Contingencies Commitments We have a non-cancelable operating lease for our headquarters in New York City (“Headquarter Lease”) that expires in 2030. Total rental payments to be paid over the course of the lease are approximately $28.8 million, which excludes our option to exercise a renewal for an additional five years commencing on the last day of the initial term. We received a rent abatement for the first eleven months of the lease arrangement. Upon the conclusion of the abatement period, annual rental payments are consistent for five years and then increase 6% for the remaining five years. We were also required to issue a letter of credit in the amount of $1.4 million as a security deposit to the landlord. We also sublease a portion of our former office space which, in connection with the signing of the Headquarter Lease, we ceased use and subsequently subleased a portion of our former office space. Rental income escalates yearly and ranges from approximately $0.3 million to $0.4 million annually for total rental income of $1.3 million. As the rental income is expected to exceed our remaining lease obligations, we will continue to record our remaining lease obligations over the course of the initial lease term. The sublease expires in March 2023. Rent expense, excluding sublease income, for each of the three months ended September 30, 2021 and 2020 was $0.8 million and rental income for the each of the three months ended September 30, 2021 and 2020 was $0.1 million. Rent expense, excluding sublease income, for each of the nine months ended September 30, 2021 and 2020 was $2.5 million and rental income for each of the nine months ended September 30, 2021 and 2020 was $0.3 million. The following represents our future minimum payments under non-cancelable leases for operating facilities as of September 30, 2021 for each of the next five years and thereafter (in thousands): 2021 (remaining) $ 880 2022 3,533 2023 3,352 2024 2,780 2025 2,885 Thereafter 13,074 Total $ 26,504 Contingencies Liabilities for loss contingencies arising from claims, assessments, litigation, fines, and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount can be reasonably estimated. If we determine that a loss is reasonably possible, and the loss or range of loss can be estimated, we will disclose the possible loss in the notes to our financial statements. Accounting for contingencies requires us to use judgment related to both the likelihood of a loss and the estimate of the amount or range of loss. Legal costs incurred in connection with loss contingencies are expensed as incurred. As previously disclosed in the final prospectus for our IPO filed with the Securities and Exchange Commission pursuant to Rule 424(b)(4) on March 18, 2021, on or about October 21, 2020, DoorDash filed a lawsuit against us in New York State Supreme Court, New York County, in a dispute over fees charged to DoorDash. On April 22, 2021, we entered into a definitive settlement agreement with DoorDash. Pursuant to the settlement, we and DoorDash agreed to a dismissal of this case in full without any amounts payable by us to DoorDash in connection with the settlement. Additionally, the parties exchanged releases. On April 22, 2021, we entered into a Restated Delivery Network Agreement (the “Restated Agreement”) with DoorDash, which replaced and superseded the Delivery Network Agreement and Rails Network Addendum, dated March 30, 2017, as previously amended on November 15, 2017 and November 12, 2020, between the Company and DoorDash. Under the terms of the Restated Agreement, we agreed to issue DoorDash a letter of credit in the amount of $25.0 million to guarantee any future unpaid and amounts owed to DoorDash under the Restated Agreement, principally related to our Dispatch module where our restaurant customers are the merchant of record and we collect funds from our restaurant customers. The letter of credit was issued on May 6, 2021. In the event that the letter of credit is drawn down by DoorDash pursuant to the terms of the Restated Agreement, we must increase the amount of such letter of credit up to a maximum of three times during the term so that the available, undrawn amount is once more in the amount of $25.0 million. See Note 7 for further details. We have also received, and may in the future continue to receive, claims from third parties asserting, among other things, infringement of their intellectual property rights. Future litigation may be necessary to defend ourselves or our 22

Q3 2021 10Q Page 27 Page 29

Q3 2021 10Q Page 27 Page 29