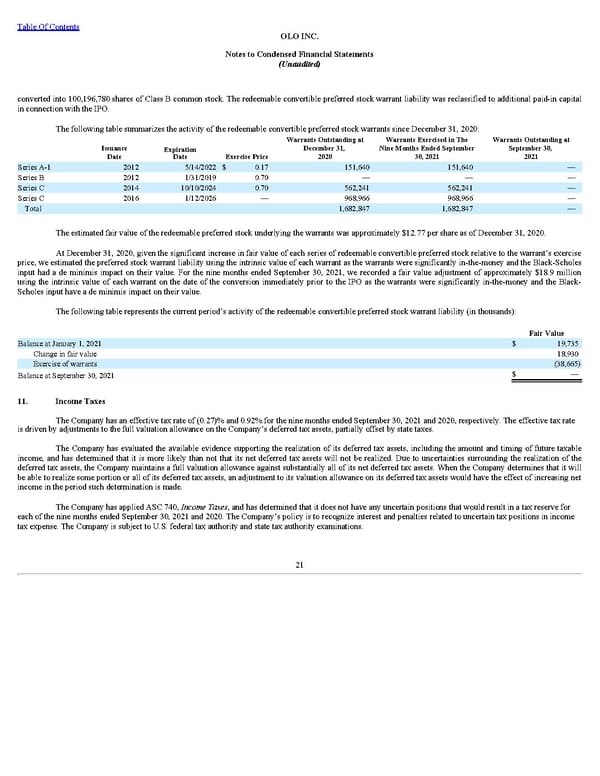

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) converted into 100,196,780 shares of Class B common stock. The redeemable convertible preferred stock warrant liability was reclassified to additional paid-in capital in connection with the IPO. The following table summarizes the activity of the redeemable convertible preferred stock warrants since December 31, 2020: Issuance Date Expiration Date Exercise Price Warrants Outstanding at December 31, 2020 Warrants Exercised in The Nine Months Ended September 30, 2021 Warrants Outstanding at September 30, 2021 Series A-1 2012 5/14/2022 $ 0.17 151,640 151,640 — Series B 2012 1/31/2019 0.70 — — — Series C 2014 10/10/2024 0.70 562,241 562,241 — Series C 2016 1/12/2026 — 968,966 968,966 — Total 1,682,847 1,682,847 — The estimated fair value of the redeemable preferred stock underlying the warrants was approximately $12.77 per share as of December 31, 2020. At December 31, 2020, given the significant increase in fair value of each series of redeemable convertible preferred stock relative to the warrant’s exercise price, we estimated the preferred stock warrant liability using the intrinsic value of each warrant as the warrants were significantly in-the-money and the Black-Scholes input had a de minimis impact on their value. For the nine months ended September 30, 2021, we recorded a fair value adjustment of approximately $18.9 million using the intrinsic value of each warrant on the date of the conversion immediately prior to the IPO as the warrants were significantly in-the-money and the Black- Scholes input have a de minimis impact on their value. The following table represents the current period’s activity of the redeemable convertible preferred stock warrant liability (in thousands): Fair Value Balance at January 1, 2021 $ 19,735 Change in fair value 18,930 Exercise of warrants (38,665) Balance at September 30, 2021 $ — 11. Income Taxes The Company has an effective tax rate of (0.27)% and 0.92% for the nine months ended September 30, 2021 and 2020, respectively. The effective tax rate is driven by adjustments to the full valuation allowance on the Company’s deferred tax assets, partially offset by state taxes. The Company has evaluated the available evidence supporting the realization of its deferred tax assets, including the amount and timing of future taxable income, and has determined that it is more likely than not that its net deferred tax assets will not be realized. Due to uncertainties surrounding the realization of the deferred tax assets, the Company maintains a full valuation allowance against substantially all of its net deferred tax assets. When the Company determines that it will be able to realize some portion or all of its deferred tax assets, an adjustment to its valuation allowance on its deferred tax assets would have the effect of increasing net income in the period such determination is made. The Company has applied ASC 740, Income Taxes , and has determined that it does not have any uncertain positions that would result in a tax reserve for each of the nine months ended September 30, 2021 and 2020. The Company’s policy is to recognize interest and penalties related to uncertain tax positions in income tax expense. The Company is subject to U.S. federal tax authority and state tax authority examinations. 21

Q3 2021 10Q Page 26 Page 28

Q3 2021 10Q Page 26 Page 28