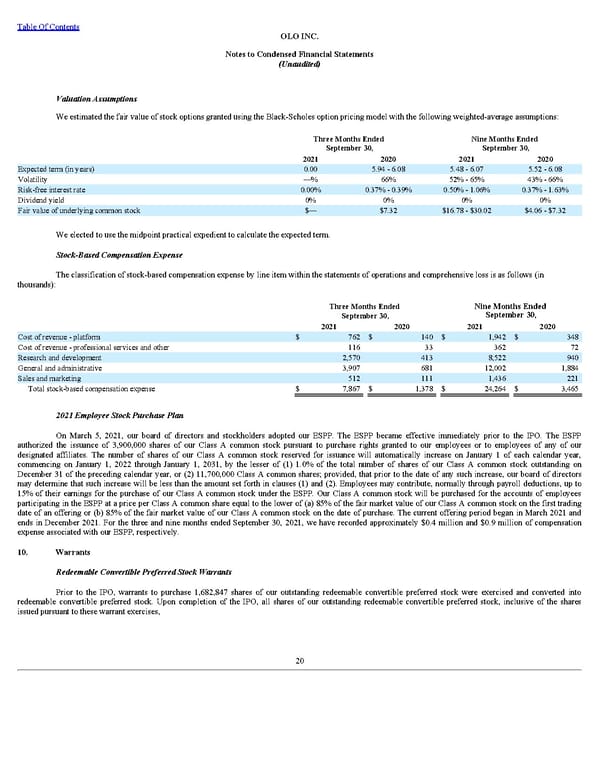

Table Of Contents OLO INC. Notes to Condensed Financial Statements (Unaudited) Valuation Assumptions We estimated the fair value of stock options granted using the Black-Scholes option pricing model with the following weighted-average assumptions: Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Expected term (in years) 0.00 5.94 - 6.08 5.48 - 6.07 5.52 - 6.08 Volatility —% 66% 52% - 65% 43% - 66% Risk-free interest rate 0.00% 0.37% - 0.39% 0.50% - 1.06% 0.37% - 1.63% Dividend yield 0% 0% 0% 0% Fair value of underlying common stock $— $7.32 $16.78 - $30.02 $4.06 - $7.32 We elected to use the midpoint practical expedient to calculate the expected term. Stock-Based Compensation Expense The classification of stock-based compensation expense by line item within the statements of operations and comprehensive loss is as follows (in thousands): Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 Cost of revenue - platform $ 762 $ 140 $ 1,942 $ 348 Cost of revenue - professional services and other 116 33 362 72 Research and development 2,570 413 8,522 940 General and administrative 3,907 681 12,002 1,884 Sales and marketing 512 111 1,436 221 Total stock-based compensation expense $ 7,867 $ 1,378 $ 24,264 $ 3,465 2021 Employee Stock Purchase Plan On March 5, 2021, our board of directors and stockholders adopted our ESPP. The ESPP became effective immediately prior to the IPO. The ESPP authorized the issuance of 3,900,000 shares of our Class A common stock pursuant to purchase rights granted to our employees or to employees of any of our designated affiliates. The number of shares of our Class A common stock reserved for issuance will automatically increase on January 1 of each calendar year, commencing on January 1, 2022 through January 1, 2031, by the lesser of (1) 1.0% of the total number of shares of our Class A common stock outstanding on December 31 of the preceding calendar year, or (2) 11,700,000 Class A common shares; provided, that prior to the date of any such increase, our board of directors may determine that such increase will be less than the amount set forth in clauses (1) and (2). Employees may contribute, normally through payroll deductions, up to 15% of their earnings for the purchase of our Class A common stock under the ESPP. Our Class A common stock will be purchased for the accounts of employees participating in the ESPP at a price per Class A common share equal to the lower of (a) 85% of the fair market value of our Class A common stock on the first trading date of an offering or (b) 85% of the fair market value of our Class A common stock on the date of purchase. The current offering period began in March 2021 and ends in December 2021. For the three and nine months ended September 30, 2021, we have recorded approximately $0.4 million and $0.9 million of compensation expense associated with our ESPP, respectively. 10. Warrants Redeemable Convertible Preferred Stock Warrants Prior to the IPO, warrants to purchase 1,682,847 shares of our outstanding redeemable convertible preferred stock were exercised and converted into redeemable convertible preferred stock. Upon completion of the IPO, all shares of our outstanding redeemable convertible preferred stock, inclusive of the shares issued pursuant to these warrant exercises, 20

Q3 2021 10Q Page 25 Page 27

Q3 2021 10Q Page 25 Page 27