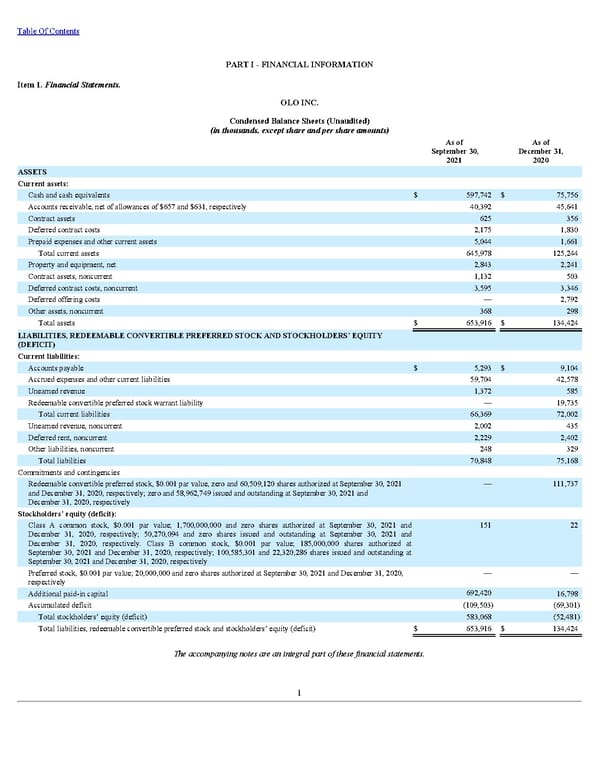

Table Of Contents PART I - FINANCIAL INFORMATION Item 1. Financial Statements. OLO INC. Condensed Balance Sheets (Unaudited) (in thousands, except share and per share amounts) As of September 30, 2021 As of December 31, 2020 ASSETS Current assets: Cash and cash equivalents $ 597,742 $ 75,756 Accounts receivable, net of allowances of $657 and $631, respectively 40,392 45,641 Contract assets 625 356 Deferred contract costs 2,175 1,830 Prepaid expenses and other current assets 5,044 1,661 Total current assets 645,978 125,244 Property and equipment, net 2,843 2,241 Contract assets, noncurrent 1,132 503 Deferred contract costs, noncurrent 3,595 3,346 Deferred offering costs — 2,792 Other assets, noncurrent 368 298 Total assets $ 653,916 $ 134,424 LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT) Current liabilities: Accounts payable $ 5,293 $ 9,104 Accrued expenses and other current liabilities 59,704 42,578 Unearned revenue 1,372 585 Redeemable convertible preferred stock warrant liability — 19,735 Total current liabilities 66,369 72,002 Unearned revenue, noncurrent 2,002 435 Deferred rent, noncurrent 2,229 2,402 Other liabilities, noncurrent 248 329 Total liabilities 70,848 75,168 Commitments and contingencies Redeemable convertible preferred stock, $0.001 par value, zero and 60,509,120 shares authorized at September 30, 2021 and December 31, 2020, respectively; zero and 58,962,749 issued and outstanding at September 30, 2021 and December 31, 2020, respectively — 111,737 Stockholders’ equity (deficit): Class A common stock, $0.001 par value; 1,700,000,000 and zero shares authorized at September 30, 2021 and December 31, 2020, respectively; 50,270,094 and zero shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively. Class B common stock, $0.001 par value; 185,000,000 shares authorized at September 30, 2021 and December 31, 2020, respectively; 100,585,301 and 22,320,286 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively 151 22 Preferred stock, $0.001 par value; 20,000,000 and zero shares authorized at September 30, 2021 and December 31, 2020, respectively — — Additional paid-in capital 692,420 16,798 Accumulated deficit (109,503) (69,301) Total stockholders’ equity (deficit) 583,068 (52,481) Total liabilities, redeemable convertible preferred stock and stockholders’ equity (deficit) $ 653,916 $ 134,424 The accompanying notes are an integral part of these financial statements. 1

Q3 2021 10Q Page 6 Page 8

Q3 2021 10Q Page 6 Page 8