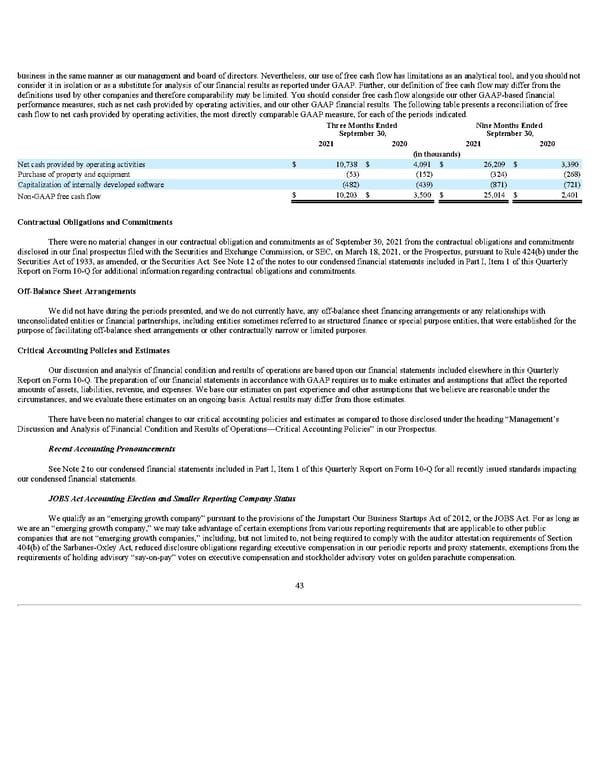

business in the same manner as our management and board of directors. Nevertheless, our use of free cash flow has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under GAAP. Further, our definition of free cash flow may differ from the definitions used by other companies and therefore comparability may be limited. You should consider free cash flow alongside our other GAAP-based financial performance measures, such as net cash provided by operating activities, and our other GAAP financial results. The following table presents a reconciliation of free cash flow to net cash provided by operating activities, the most directly comparable GAAP measure, for each of the periods indicated. Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 (in thousands) Net cash provided by operating activities $ 10,738 $ 4,091 $ 26,209 $ 3,390 Purchase of property and equipment (53) (152) (324) (268) Capitalization of internally developed software (482) (439) (871) (721) Non-GAAP free cash flow $ 10,203 $ 3,500 $ 25,014 $ 2,401 Contractual Obligations and Commitments There were no material changes in our contractual obligation and commitments as of September 30, 2021 from the contractual obligations and commitments disclosed in our final prospectus filed with the Securities and Exchange Commission, or SEC, on March 18, 2021, or the Prospectus, pursuant to Rule 424(b) under the Securities Act of 1933, as amended, or the Securities Act. See Note 12 of the notes to our condensed financial statements included in Part I, Item 1 of this Quarterly Report on Form 10-Q for additional information regarding contractual obligations and commitments. Off-Balance Sheet Arrangements We did not have during the periods presented, and we do not currently have, any off-balance sheet financing arrangements or any relationships with unconsolidated entities or financial partnerships, including entities sometimes referred to as structured finance or special purpose entities, that were established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes. Critical Accounting Policies and Estimates Our discussion and analysis of financial condition and results of operations are based upon our financial statements included elsewhere in this Quarterly Report on Form 10-Q. The preparation of our financial statements in accordance with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. We base our estimates on past experience and other assumptions that we believe are reasonable under the circumstances, and we evaluate these estimates on an ongoing basis. Actual results may differ from those estimates. There have been no material changes to our critical accounting policies and estimates as compared to those disclosed under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies” in our Prospectus. Recent Accounting Pronouncements See Note 2 to our condensed financial statements included in Part I, Item 1 of this Quarterly Report on Form 10-Q for all recently issued standards impacting our condensed financial statements. JOBS Act Accounting Election and Smaller Reporting Company Status We qualify as an “emerging growth company” pursuant to the provisions of the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as we are an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and stockholder advisory votes on golden parachute compensation. 43

Q3 2021 10Q Page 48 Page 50

Q3 2021 10Q Page 48 Page 50