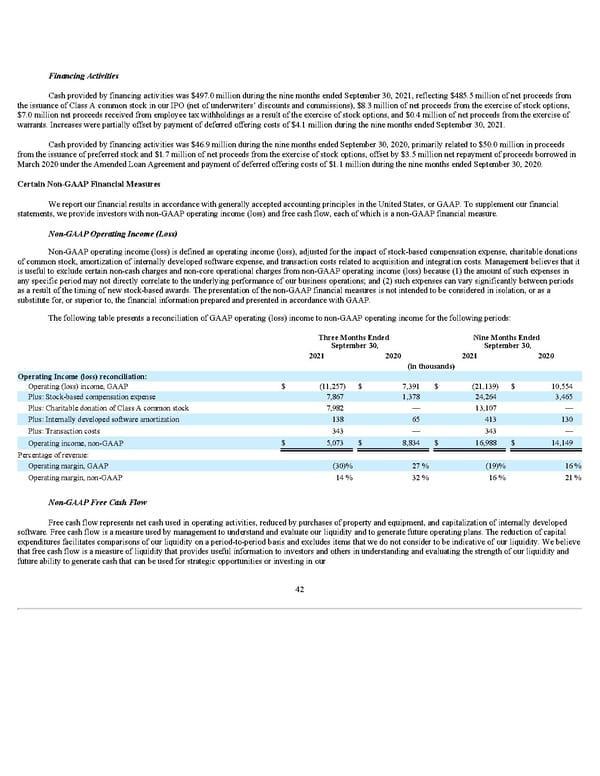

Financing Activities Cash provided by financing activities was $497.0 million during the nine months ended September 30, 2021, reflecting $485.5 million of net proceeds from the issuance of Class A common stock in our IPO (net of underwriters’ discounts and commissions), $8.3 million of net proceeds from the exercise of stock options, $7.0 million net proceeds received from employee tax withholdings as a result of the exercise of stock options, and $0.4 million of net proceeds from the exercise of warrants. Increases were partially offset by payment of deferred offering costs of $4.1 million during the nine months ended September 30, 2021. Cash provided by financing activities was $46.9 million during the nine months ended September 30, 2020, primarily related to $50.0 million in proceeds from the issuance of preferred stock and $1.7 million of net proceeds from the exercise of stock options, offset by $3.5 million net repayment of proceeds borrowed in March 2020 under the Amended Loan Agreement and payment of deferred offering costs of $1.1 million during the nine months ended September 30, 2020. Certain Non-GAAP Financial Measures We report our financial results in accordance with generally accepted accounting principles in the United States, or GAAP. To supplement our financial statements, we provide investors with non-GAAP operating income (loss) and free cash flow, each of which is a non-GAAP financial measure. Non-GAAP Operating Income (Loss) Non-GAAP operating income (loss) is defined as operating income (loss), adjusted for the impact of stock-based compensation expense, charitable donations of common stock, amortization of internally developed software expense, and transaction costs related to acquisition and integration costs. Management believes that it is useful to exclude certain non-cash charges and non-core operational charges from non-GAAP operating income (loss) because (1) the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations; and (2) such expenses can vary significantly between periods as a result of the timing of new stock-based awards. The presentation of the non-GAAP financial measures is not intended to be considered in isolation, or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The following table presents a reconciliation of GAAP operating (loss) income to non-GAAP operating income for the following periods: Three Months Ended September 30, Nine Months Ended September 30, 2021 2020 2021 2020 (in thousands) Operating Income (loss) reconciliation: Operating (loss) income, GAAP $ (11,257) $ 7,391 $ (21,139) $ 10,554 Plus: Stock-based compensation expense 7,867 1,378 24,264 3,465 Plus: Charitable donation of Class A common stock 7,982 — 13,107 — Plus: Internally developed software amortization 138 65 413 130 Plus: Transaction costs 343 — 343 — Operating income, non-GAAP $ 5,073 $ 8,834 $ 16,988 $ 14,149 Percentage of revenue: Operating margin, GAAP (30) % 27 % (19) % 16 % Operating margin, non-GAAP 14 % 32 % 16 % 21 % Non-GAAP Free Cash Flow Free cash flow represents net cash used in operating activities, reduced by purchases of property and equipment, and capitalization of internally developed software. Free cash flow is a measure used by management to understand and evaluate our liquidity and to generate future operating plans. The reduction of capital expenditures facilitates comparisons of our liquidity on a period-to-period basis and excludes items that we do not consider to be indicative of our liquidity. We believe that free cash flow is a measure of liquidity that provides useful information to investors and others in understanding and evaluating the strength of our liquidity and future ability to generate cash that can be used for strategic opportunities or investing in our 42

Q3 2021 10Q Page 47 Page 49

Q3 2021 10Q Page 47 Page 49